NASDAQ Today: Key Insights and Market Movements

Introduction

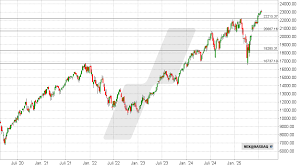

The NASDAQ stock exchange is a critical barometer for the technology sector and overall market health. With a blend of large-tech giants and new startups, the NASDAQ serves as an essential platform for investors to gauge economic conditions. As of today, market trends are revealing intriguing patterns and movements that merit attention.

Market Overview

As of the latest trading data, the NASDAQ composite has shown a modest increase of 0.5%, currently sitting at approximately 14,200 points. This rise comes amid a backdrop of fluctuating economic indicators and earnings reports from tech companies, which have driven the market sentiment.

Recent Performances

Prominent technology stocks have experienced mixed results today. For instance, Apple Inc. saw a 1.2% increase after announcing positive earnings, while Microsoft shares dipped by 0.6% following concerns over upcoming regulatory challenges in Europe. Tesla, on the other hand, rallied 2% amid reports of increased production efficiency in its factories.

Sector Performance

The technology sector continues to lead the way, with substantial contributions from software and hardware companies. However, the biotechnology sector also demonstrated resilience with shares of major pharmaceutical firms climbing due to favorable research data releases. Investors are keeping an eye on inflation data scheduled to be released later this week, which could influence market dynamics significantly.

Conclusion

In summary, the NASDAQ today is a reflection of ongoing economic challenges and opportunities, particularly within the technology sector. As investors navigate through mixed earnings reports and impending economic indicators, staying informed becomes crucial. With market volatility likely to continue, those looking to invest on the NASDAQ must consider both current trends and future forecasts carefully. Analysts predict that the tech-heavy index will continue to showcase resilience if companies maintain strong earnings and manage challenges effectively. The coming weeks will be pivotal for investors to observe how these trends play out against the backdrop of the broader economy.