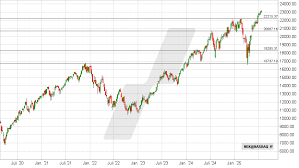

NASDAQ Index: Tech Giants and AI Drive Market Momentum in 2025

Market Performance and Current Trends

The U.S. stock market has demonstrated remarkable strength, with major equity benchmarks posting double-digit returns amid positive economic activity, robust corporate earnings growth, and easing monetary policy by global central banks.

Key economic indicators paint a positive picture, with GDP growth at 2.7% year-over-year, low unemployment at 4.1%, increased consumer spending of 3.7%, and falling inflation. Corporate profits are particularly strong, with S&P 500 earnings expected to grow 9.4% in 2024 and 14.8% in 2025.

Technology Sector Leadership

Artificial intelligence (AI) continues to be a dominant market driver, showing strong infrastructure investment and economic contributions. However, high expectations are becoming a potential headwind, as evidenced by NVIDIA’s muted earnings reaction.

NVIDIA has been at the forefront of the AI revolution, with its graphics processing units (GPUs) serving as the ‘brains’ that power AI-accelerated data centers.

Market Outlook and Challenges

September and October traditionally bring increased market fluctuations and softer returns, though these headwinds tend to be short-lived with markets often rebounding strongly afterward. Investment discipline remains crucial as the market digests summer gains and leadership potentially broadens. A well-diversified portfolio may benefit from the expanding opportunity set across asset classes in a cooling but fundamentally strong market.

Looking ahead, the U.S. economy and stock market face a confluence of challenges in the second half of the year, including complex policy decisions around tariffs and immigration, labor market dynamics, and fiscal pressures.

Federal Reserve Impact

Federal Reserve policy expectations are shifting, with growing anticipation of interest rate cuts. This development has sparked renewed interest and a rotation toward rate-sensitive sectors.