Mark Carney and the Consumer Carbon Tax: What You Need to Know

Introduction

The debate surrounding the consumer carbon tax has gained significant attention as climate change continues to pose a critical challenge globally. As an influential figure in environmental finance, Mark Carney, former Governor of the Bank of Canada and the Bank of England, emphasizes the importance of a consumer carbon tax to mitigate greenhouse gas emissions and encourage sustainable practices. Understanding Carney’s stance can provide valuable insights into the future of environmental policy in Canada.

Mark Carney’s Vision

Mark Carney has been a vocal advocate for integrating environmental considerations into financial decision-making. With the increasing urgency to address climate change, he has called for a comprehensive approach that includes pricing carbon emissions. Carney’s proposal for a consumer carbon tax aims to reflect the true cost of carbon emissions, providing an economic incentive for individuals and businesses to reduce their environmental footprint.

The Implications of a Carbon Tax

Carney argues that implementing a carbon tax would encourage manufacturers and consumers to shift toward greener alternatives by making fossil fuels more expensive and renewable energy more attractive. This shift could promote innovation in clean technology, create jobs in the renewable sector, and ultimately lead to a more sustainable economy. Critics, however, worry about the potential impact on households, particularly lower-income families who may find it challenging to absorb increased costs.

Recent Developments

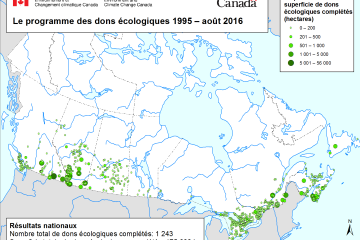

As countries across the globe, including Canada, strive to meet their climate targets, discussions around carbon pricing have intensified. Recent studies indicate that a well-structured consumer carbon tax could be instrumental in achieving Canada’s commitment to reducing its carbon emissions by 40% by 2030. Carney has highlighted that such measures can also spur investments in sustainable infrastructure, paving the way for greener cities and communities.

Conclusion

As the dialogue around environmental sustainability escalates, Mark Carney’s advocacy for a consumer carbon tax signifies a necessary step towards comprehensive climate action. By promoting a carbon pricing framework, Carney seeks to align economic growth with environmental responsibility. The real question is how policymakers will balance these objectives while addressing the needs of all Canadians, especially vulnerable communities. Moving forward, the success of such initiatives will depend on public acceptance and government support, making this a critical issue for the Canadian populace.