Lucid Motors: Stock Challenges and Strategic Moves Shape Company’s Future

Market Position and Recent Developments

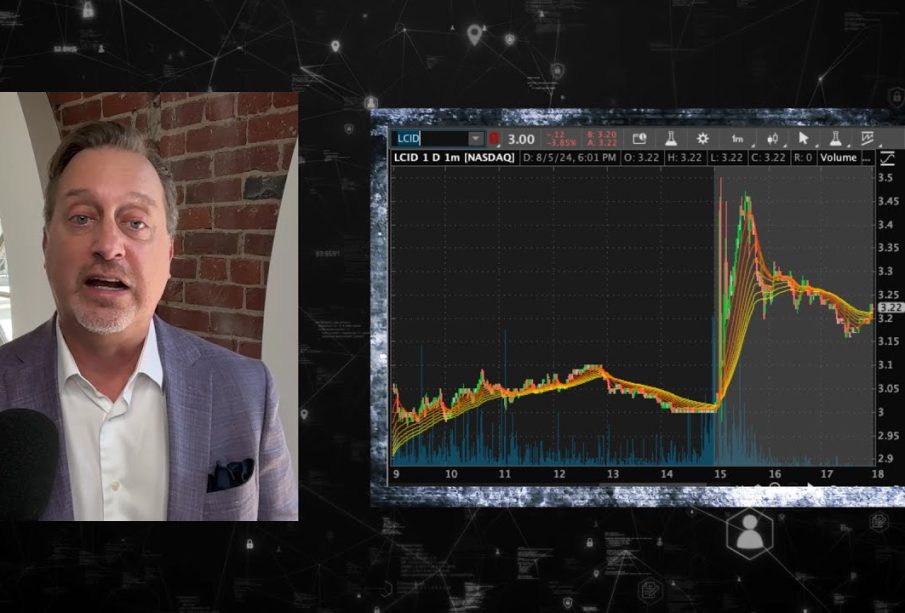

Lucid Group has recently disappointed investors with weak Q2 results, featuring revenue misses along with increased losses and cash burn. The company’s stock has declined sharply following second-quarter earnings that missed expectations.

In response to market pressures, Lucid Group has implemented a significant corporate action – a 1-for-10 reverse stock split, which became effective September 2, 2025.

Financial Performance and Challenges

The company’s latest earnings report fell short of market expectations. For the current year, Lucid has adjusted its production forecast downward, now anticipating to produce between 18,000 and 20,000 vehicles.

The company’s financial position shows some mixed signals. While carrying a long-term debt of $2,078 million, Lucid maintains working capital of $3,091 million for daily operations. The company does demonstrate solid liquidity with a current ratio of 3.3, indicating sufficient assets to cover short-term obligations.

Strategic Initiatives and Future Outlook

Lucid is pursuing international expansion, particularly in Saudi Arabia, where it’s participating in Special Economic Zones to support the Kingdom’s Vision 2030 economic diversification plans.

The company has formed strategic partnerships, notably with Uber, though this presents both opportunities and challenges. Lucid’s limited production capacity is under strain from multiple demands, which could impact its ability to meet strategic goals. The company faces significant pressure to optimize production as it pushes for a larger presence in the robotaxi market.

Market analysts currently maintain a cautious outlook on Lucid stock, with several negative signals suggesting potentially weak performance in the near term.