Lithium Americas Stock: Trends and Developments in 2023

Introduction

Lithium Americas Corp. has garnered significant attention in the investment community as the demand for lithium continues to surge. As electric vehicles and renewable energy technologies rise in prominence, the production of lithium—a key component in batteries—has become essential. Understanding the current status and potential of Lithium Americas stock is vital for investors looking to capitalize on this booming market.

Current Status of Lithium Americas Stock

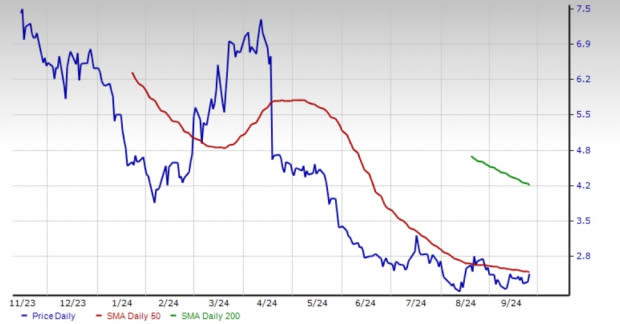

As of October 2023, Lithium Americas (NYSE: LAC) has experienced fluctuations in its stock price largely influenced by market dynamics and company-specific developments. The stock has seen a year-to-date increase, primarily driven by expanding operations in lithium production and the increasing global demand for electric vehicles.

Recent announcements have highlighted significant progress in the company’s flagship projects, particularly the Thacker Pass lithium project located in Nevada. Expected to be one of the largest lithium resources in North America, this project has captured the interest of both investors and industry analysts.

Factors Impacting Stock Performance

Multiple factors contribute to the performance of Lithium Americas stock:

- Market Demand: The escalating demand for lithium due to the electric vehicle boom is a major determinant of stock performance. Industry experts predict that demand will continue to grow, positively impacting prices.

- Regulatory Approvals: Obtaining necessary permits and approvals has been a challenge for lithium projects. Lithium Americas has made strides in this area, with updates indicating faster progress through the regulatory maze.

- Partnerships and Collaborations: The formation of strategic partnerships enhances Lithium Americas’ market position. Recent collaborations with major automotive firms have increased visibility and potential sales.

Market Predictions and Outlook

Analysts remain optimistic about Lithium Americas’ future, with several forecasting a steady upward trajectory for the stock. The integration of sustainable practices and innovative technologies in the extraction process is expected to enhance operational efficiency and reduce environmental impact, making Lithium Americas a competitive player in the lithium market.

Furthermore, as other countries ramp up their pledges towards carbon neutrality and clean energy, the demand for lithium is projected to rise significantly. This growing trend could lead to substantial growth opportunities for Lithium Americas, with investors keeping a keen eye on upcoming quarterly reports and project milestones.

Conclusion

In conclusion, Lithium Americas stock represents not only a compelling investment opportunity but also a critical piece of the puzzle in the evolving landscape of renewable energy. With several positive developments on the horizon and a market poised for growth, stakeholders and investors are encouraged to stay informed about the company’s advancements and industry trends.