Latest Trends in the Shanghai Index: What You Need to Know

Understanding the Shanghai Index

The Shanghai Index, officially known as the Shanghai Composite Index, is a crucial indicator of the Chinese stock market’s performance. Comprising all listed stocks on the Shanghai Stock Exchange, it reflects the overall economic health of the country and is an important bellwether for global markets. Recent developments in the Shanghai Index have garnered intense focus due to ongoing economic fluctuations in China.

Current Performance of the Shanghai Index

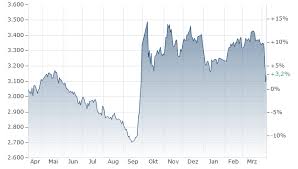

As of mid-October 2023, the Shanghai Index has experienced notable volatility, influenced by a combination of domestic and international factors. Recent reports indicate that the index has struggled to maintain upward momentum, averaging around 3,200 points. Analysts attribute this stagnation to a series of regulatory crackdowns on technology firms, a decelerating economy, and ongoing concerns regarding the real estate sector.

Economic Factors at Play

China’s economic environment has seen a slowdown, with GDP growth reported at the lowest level in decades. The tightening of regulations in the technology sector has alleviated some investor confidence, leading to cautious trading practices. Additionally, uncertainties surrounding US-China relations have prompted foreign investors to reevaluate their positions in the Chinese market.

Future Projections for Investors

Looking ahead, economists anticipate that the Shanghai Index may continue to face pressure in the short term. However, as measures aimed at stabilizing the economy take effect, there could be opportunities for recovery. Stimulus plans announced by the Chinese government, combined with an easing of monetary policy, could enhance market sentiment. Investors are advised to monitor these developments closely, as shifts in policy or significant events could markedly influence index performance.

Conclusion

The Shanghai Index remains a critical indicator of not only China’s economic outlook but also its impact on global markets. As investors navigate this volatile landscape, staying informed about the index’s movements and the underlying economic factors will be essential. While challenges persist, potential recovery measures could pave the way for a more optimistic outlook for the Shanghai Index in the coming months.