Latest Trends in Enbridge Stock Performance

Understanding Enbridge Stock and Its Importance

Enbridge Inc., a major Canadian energy infrastructure company, plays a significant role in the North American energy sector with its extensive pipeline network and renewable energy initiatives. The performance of Enbridge stock is particularly relevant for investors looking to navigate the fluctuating energy market amidst rising global demand for energy and a transitioning focus towards sustainability.

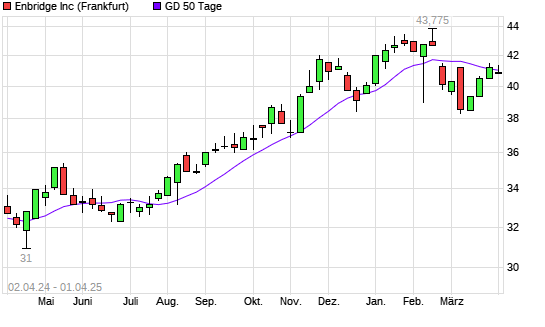

Current Performance and Trends

As of October 2023, Enbridge stock has shown a fluctuating performance due to various factors affecting the energy market, including geopolitical tensions, fluctuations in oil prices, and evolving regulations surrounding fossil fuels. Recent reports highlight that Enbridge’s stock is trading at around CAD 52, reflecting an increase of approximately 8% over the last quarter, buoyed by strong quarterly earnings that exceeded analysts’ expectations.

In its latest earnings report, Enbridge revealed a net income increase of 15% year-over-year, driven by growth in its liquids and natural gas transportation segments. Analyst forecasts remain optimistic, suggesting a continued upward trajectory for Enbridge stock as the company adapts its business model towards increasing renewable energy projects, aiming to reach a significant portion of its portfolio in green energy by 2030.

Analyst Opinions and Market Predictions

Market analysts remain cautiously optimistic about Enbridge stock. Investment firms such as RBC Capital Markets have set a target price of CAD 58 for the stock, citing the company’s robust cash flow and strategic initiatives in renewable energy as factors that will support future growth. Additionally, the company’s commitment to shareholder returns through dividends remains a focal point, with Enbridge boasting one of the highest dividend yields in the sector, currently hovering around 6.75%.

Conclusion: What Does This Mean for Investors?

For investors, understanding the dynamics of Enbridge stock is crucial in making informed investment decisions. The combination of stable dividends, strategic expansion in renewable energy, and ongoing support from the liquid and natural gas sectors positions Enbridge as a potentially solid long-term investment. However, prospective investors should also consider external challenges, such as environmental regulations and market volatility. Overall, the outlook for Enbridge stock remains positive as the company continues to align with global energy transition trends while providing value to shareholders.