Latest Trends in Amazon Stock Price: What Investors Need to Know

Introduction

The stock price of Amazon, one of the world’s largest e-commerce and cloud computing companies, holds significant relevance for investors, analysts, and market enthusiasts. Given Amazon’s vast influence on the stock market and the retail landscape, fluctuations in its stock price can imply broader economic trends and consumer behavior.

Current Market Status

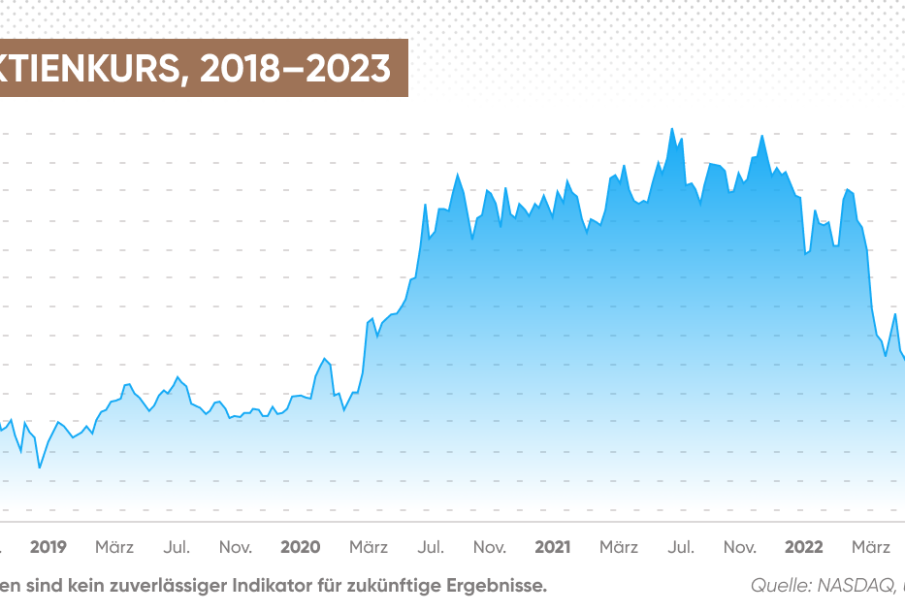

As of October 2023, Amazon’s stock price has seen notable variations, reflecting the challenges and opportunities within the tech and retail segments. Recently, Amazon shares hovered around CAD $150, a slight increase compared to prior months. This rise can be attributed to several factors including improved e-commerce sales, expansion in Amazon Web Services (AWS), and effective cost management strategies. Financial analysts predict a stable growth trajectory following the positive earnings report released last month, which exceeded market expectations.

Factors Influencing Stock Fluctuations

Numerous factors influence Amazon’s stock price, including:

- Earnings Reports: Amazon’s quarterly earnings significantly impact investor sentiment. The recent report indicated a 20% year-on-year growth in revenue, primarily driven by the holiday shopping season and increased AWS adoption.

- Market Competition: Competition from other giants like Walmart and Alibaba continues to pressure Amazon’s market share, influencing stock performance. Innovations in delivery services and pricing strategies are critical to retaining customer loyalty.

- Economic Conditions: Global economic indicators such as inflation rates and consumer spending directly affect Amazon’s business model and consequently, its stock price. With fluctuating economic conditions, investors are keeping a close watch.

- Technological Advancements: Amazon’s investments in automation and AI technology not only enhance efficiency but are seen as a long-term growth strategy that could elevate stock performance.

Conclusion

As investors analyze the implications of current trends, understanding the factors influencing Amazon’s stock price is essential. With consistent growth in its logistics network and cloud services, the outlook remains optimistic. Industry experts forecast that as long as Amazon maintains its competitive edge, the stock may continue to trend upwards, although vigilance regarding market shifts is crucial. Investors should assess their portfolios accordingly, considering both short-term volatility and long-term growth potential in the tech sector.