Latest Insights on Novo Nordisk Stock Performance

Introduction

Novo Nordisk, a global leader in diabetes care and hormone replacement therapy, has seen its stock becoming increasingly relevant in today’s financial landscape. Financial analysts and investors are closely monitoring Novo Nordisk stock as the company continues to drive innovation in its product offerings and expand its market reach. Recent trends indicate a notable increase in share value, driven by strong earnings reports and a robust pipeline of new therapies.

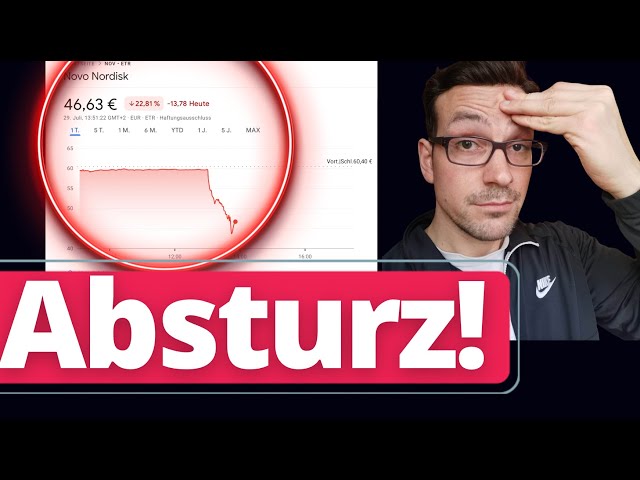

Recent Performance

As of October 2023, Novo Nordisk stock has experienced significant growth, outperforming many competitors in the pharmaceutical sector. The stock price has surged approximately 25% year to date, increasing from around $100 to $125 per share, following the company’s favorable quarterly earnings and increased demand for its diabetes drug Ozempic.

In the latest earnings report, Novo Nordisk revealed that sales for its diabetes and obesity care products grew by 40% compared to the previous year. This growth has been attributed to an influx of patients seeking effective treatments for obesity, highlighting a growing health crisis globally. Moreover, the company reported a net income of $1.6 billion, exceeding analysts’ expectations and reinforcing investor confidence.

Market Trends and Developments

The pharmaceutical industry is facing challenges, including regulatory shifts and pricing pressures, but Novo Nordisk is navigating these changes effectively. The company’s commitment to research and development, with an investment constituting approximately 20% of its annual revenue, positions it well against competitors. New therapies in the pipeline, particularly for obesity and rare diseases, are expected to further enhance the company’s market position.

Furthermore, with increasing focus on health and weight management among consumers, Novo Nordisk’s products like Wegovy have gained traction. This has prompted the company to broaden its outreach and promotional efforts, potentially driving future sales growth.

Conclusion

The outlook for Novo Nordisk stock remains optimistic, with many analysts predicting continued growth supported by robust sales, innovative product offerings, and a strong commitment to addressing global health challenges. Investors are advised to stay informed about upcoming product launches and market dynamics, as these factors will play a crucial role in the stock’s future performance. As the healthcare landscape evolves, Novo Nordisk is likely to be at the forefront of addressing the growing demand for effective diabetes and obesity solutions. Monitoring the sustainability of these trends will be essential for making informed investment decisions.