Latest Developments in INTC Stock Performance

Introduction

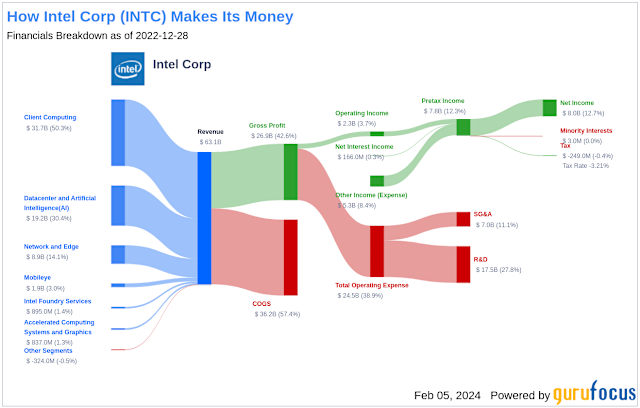

Intel Corporation (NASDAQ: INTC) has been a central player in the semiconductor industry for decades. As a bellwether stock, INTC’s performance is closely watched by investors and analysts alike. Recently, developments in technology, competition, and economic conditions have significantly influenced its stock trajectory, making it a hot topic in investment circles.

Recent Performance

As of late October 2023, INTC stock has shown fluctuations in prices, largely driven by quarterly earnings reports and market reactions to new product launches. After reporting its Q3 earnings on October 26, Intel announced revenues of $15.3 billion, falling short of analysts’ expectations, which had anticipated around $16 billion. This caused a noticeable drop in stock price post-announcement, with shares shedding approximately 5% over the following two days.

Market Reaction and Investor Sentiment

Market analysts have expressed mixed sentiments about Intel’s future. Some emphasize the company’s continued investment in cutting-edge technologies and attempts to reclaim its market supremacy in a fiercely competitive environment. For instance, Intel’s ongoing transitions to advanced process nodes and investment into artificial intelligence and data centers are seen as potential long-term growth drivers.

On the other hand, competitors like AMD and NVIDIA have outperformed Intel in recent quarters, particularly in the high-performance computing and gaming sectors. This competitive pressure has raised concerns among investors regarding Intel’s ability to regain its lost market share.

Outlook and Forecast

Looking ahead, analysts forecast a recovery in INTC stock, contingent on product launches slated for 2024 that aim to address both consumer and enterprise needs. The upcoming introduction of new chips and enhanced fabrication technology may create new revenue streams and encourage renewed investor confidence.

The broader economic conditions, including interest rates and supply chain challenges, also play a critical role in shaping the stock’s future trajectory. As inflation rates stabilize and the global chip shortage eases, analysts predict a more favorable environment for semiconductor companies, including Intel.

Conclusion

Investors in INTC stock should monitor the upcoming product launches and the company’s strategic directions closely. While recent performance has raised concerns, the potential for recovery through innovation and adaptation cannot be overlooked. Staying informed about ongoing market dynamics will be essential for making sound investment decisions in the semiconductor sector.