Latest Bank of Canada Interest Rate Decision: Key Insights

Introduction

The Bank of Canada (BoC) plays a crucial role in shaping the economic landscape of Canada through its monetary policy, particularly regarding interest rates. Recent decisions by the BoC have garnered significant attention as they directly impact borrowing costs, inflation rates, and overall economic growth. As the nation navigates through economic recovery post-pandemic and faces rising inflation, understanding these interest rate decisions is vital for both consumers and investors.

Current Interest Rate Trends

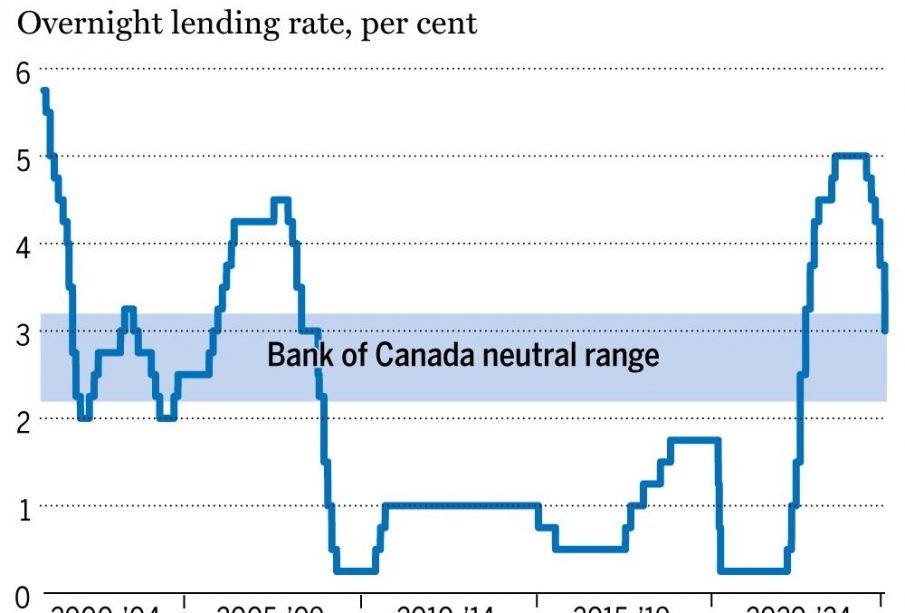

On October 25, 2023, the Bank of Canada announced a decision to maintain its benchmark interest rate at 5.00%. This decision comes after a series of hikes aimed at curbing persistent inflation, which has remained above the target range of 1-3%. The BoC had previously raised rates multiple times throughout 2022 and 2023, reflecting the need to manage demand and keep inflation in check.

Factors Influencing the Decision

Several factors influenced the BoC’s latest decision. Firstly, inflation rates have shown signs of moderation, dropping to 4.2% in September 2023 from higher peaks earlier in the year. Additionally, the Canadian economy has demonstrated resilience, with a GDP growth rate of 2.5% in the most recent quarter, although analysts warn about potential slowdowns driven by high-interest rates affecting consumer spending and business investment.

Moreover, the sluggish housing market, which has faced challenges due to increased borrowing costs, also weighed heavily on the decision. The BoC has indicated that it monitors not just inflation but broader economic conditions, including housing prices and consumer confidence.

Implications for Canadians

The BoC’s decision to hold the interest rate steady may provide some relief for consumers already burdened with high mortgage and loan payments. However, financial experts urge Canadians to remain vigilant as global economic uncertainties, including geopolitical tensions and supply chain issues, could affect future interest rate adjustments.

Conclusion

As we look to the future, economists predict that while the current rate may hold for the immediate term, a cautious approach is warranted. The Bank of Canada will likely continue to evaluate economic indicators keenly and adjust its policies accordingly. For Canadians, staying informed about these decisions can aid in financial planning, particularly with respect to real estate investments, loans, and general consumer spending.

As the situation evolves, observers suggest to keep an eye on inflation trends and economic growth metrics, which will be pivotal in the BoC’s upcoming monetary policy decisions.