Krispy Kreme Stock Performance and Market Insights

Introduction

Krispy Kreme, the iconic doughnut company, has made waves on the stock market since its IPO in 2021. For investors and fans of the brand alike, understanding the performance of Krispy Kreme stock is crucial given the rising interest in fast-food franchises and their economic resilience. As food trends evolve and consumer preferences shift, the potential for growth and profitability in this sector warrants attention.

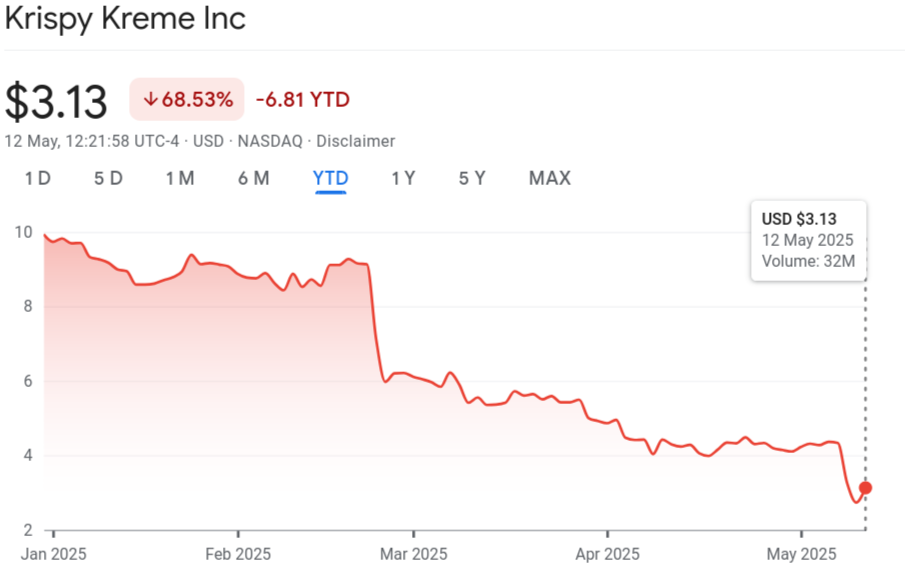

Current Stock Performance

As of October 2023, Krispy Kreme, Inc. (DNUT) trades on the NASDAQ and has shown a relatively stable performance in the competitive fast-food market. The stock’s price, hovering around $15 per share, indicates a modest increase compared to last year, where the price fluctuated between $11 and $17. Analysts attribute this resilience to several key factors, including the brand’s expansion strategies and product line diversification.

Strategic Expansions and Innovations

Krispy Kreme has actively pursued expansion both domestically and internationally. The launch of new stores, particularly in high-growth markets and a push to introduce innovative products, has played a pivotal role in driving demand. For instance, the introduction of seasonal and limited-edition doughnuts has helped to attract both new and repeat customers, bolstering sales performance. Additionally, the company’s commitment to digital ordering and delivery initiatives reflects a strategic pivot towards convenience, which resonates well with the current consumer trends.

Market Sentiment and Analyst Insights

Market analysts remain optimistic about the future of Krispy Kreme stock. Many suggest that the company’s strategic moves, including partnerships and franchise expansions, will continue to enhance its market presence. Some analysts predict a target price range of $18 to $22 over the next year, citing overarching trends towards indulgent treats and experiential dining as contributing factors to future growth. However, there are caution flags regarding inflationary pressures affecting ingredient costs and operational expenses that could impact margins.

Conclusion

For investors watching Krispy Kreme stock, the current performance demonstrates not only the company’s resilience but also its potential for future growth. With strategic expansions and a strong brand identity, it could be an attractive option in the fast-food sector. However, it is essential to consider broader economic factors and market trends that could influence future performance. As Krispy Kreme continues to innovate and adapt, potential investors should stay informed of the latest developments to make well-informed decisions.