IREN Stock: Current Performance and Future Outlook

Introduction

IREN stock, associated with IREN SpA, a prominent player in the Italian energy and utility sector, has been in the spotlight recently. Its performance is crucial for investors keen on understanding market trends in sustainable energy. Following significant changes in the global economic landscape, monitoring IREN’s stock is particularly relevant.

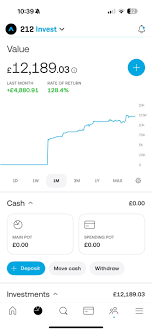

Recent Performance

As of October 2023, IREN stock has demonstrated resilience amid market volatility. Over the past month, the stock price has fluctuated between €2.70 and €2.90, reflecting a stable performance compared to its peers in the sector. Analysts pinpointed recent quarterly earnings, which reported a revenue increase of 7% year-over-year, attributed to a rise in demand for renewable energy services.

Market Trends and Analysis

The utility sector is undergoing a transformation, largely driven by policies aimed at carbon neutrality and sustainable practices. IREN has positioned itself to capitalize on these trends by investing in renewable projects, such as solar and wind energy. Market analysts suggest that this strategic pivot aligns with Italy’s commitment to increase renewable energy sources by 2030. Furthermore, rising energy prices have offered a buffer against economic shocks, making IREN’s offerings increasingly attractive to investors.

Implications for Investors

For potential investors monitoring IREN stock, the outlook remains optimistic. Analysts believe that the company’s proactive investments in green technology and a diversified energy portfolio will likely lead to continued growth. Reports forecast a potential price target of around €3.20 within the next year, considering favorable regulatory environments and increasing market share in renewable energy.

Conclusion

In conclusion, IREN stock represents a compelling opportunity in the current market landscape. With solid fundamentals and a clear strategy focused on sustainability, investors might find value in this utility company as it continues to evolve. Monitoring global energy policy changes and staying updated on quarterly earnings will be essential for those interested in making informed decisions regarding IREN stock. As the energy sector pivots towards more sustainable practices, IREN’s commitment could position it as a frontrunner in the industry.