Investing in Oklo Stock: Current Trends and Market Insights

Introduction

As the renewable energy sector continues to expand, Oklo Inc., a startup focused on innovative nuclear technology, has attracted significant attention among investors. The company’s mission to provide safe and efficient nuclear power solutions aligns with global efforts to combat climate change, making Oklo stock a potentially attractive option for both environmentally-conscious investors and those looking to diversify their portfolios.

Current Market Performance

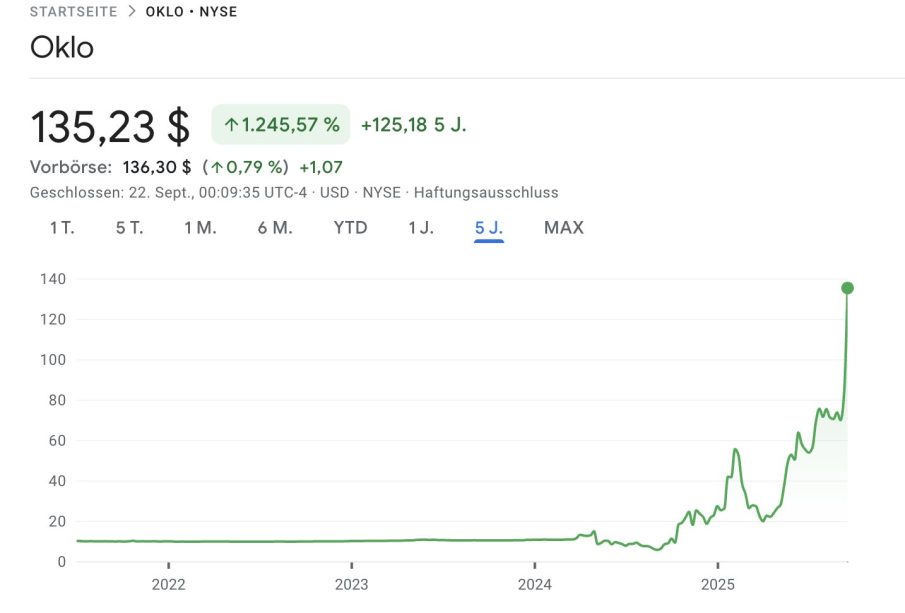

In recent weeks, Oklo stock has seen fluctuations indicative of broader market trends impacting technology and energy sectors. Since its IPO earlier this year, shares have fluctuated between $12 and $18. This volatility is not uncommon, particularly for companies within the renewable energy space that are scaling operations and establishing their market presence.

Key Developments Affecting Stock Price

Several factors have influenced Oklo’s stock price. In September 2023, the company announced significant partnerships with major energy firms aimed at expanding their deployment of small modular reactors (SMRs). These partnerships have strengthened investor confidence, pushing the stock price upwards following the announcement. Additionally, recent regulatory support for nuclear innovations has further buoyed investor sentiment towards Oklo’s future profitability.

Challenges Ahead

However, Oklo faces challenges that could affect its stock performance. The nuclear energy sector often confronts regulatory hurdles and public skepticism surrounding safety and environmental concerns. Any adverse developments in regulatory reviews or safety incidents could negatively impact investor confidence and stock prices.

Conclusion

For potential investors, Oklo stock represents both opportunity and risk. Given the increasing global demand for sustainable energy solutions, Oklo’s innovative approach positions it well for future growth. However, caution is advised due to inherent market volatility and regulatory challenges. Investors should conduct thorough research and consider market trends when assessing the viability of Oklo stock in their investment strategy. As the industry evolves, Oklo’s stock could become a pivotal player in the fight against climate change and might yield significant returns for those willing to navigate the challenges ahead.