Intel Stock: Analyzing Current Performance and Future Trends

Introduction

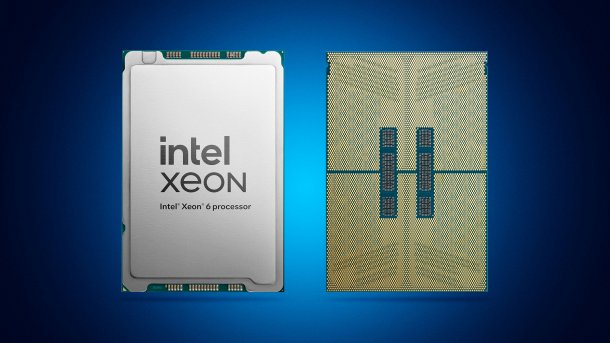

Intel Corporation, one of the leading semiconductor manufacturers in the world, has been a focal point for investors, particularly with its stock’s fluctuating performance amid global economic changes. With the demand for advanced computing technology on the rise, understanding the dynamics of Intel’s stock is essential for both current shareholders and potential investors. The recent trends and forecasts regarding Intel stocks reveal significant implications for the broader technology market.

Current Stock Performance

As of October 2023, Intel’s stock (INTC) has shown a modest recovery, trading around $30 per share. Over the past year, the stock has experienced notable volatility, with a decline attributed to factors such as supply chain disruptions and increased competition in the semiconductor sector. Despite these challenges, Intel’s strategic initiatives and investments in AI and cloud computing technologies have provided a glimmer of hope for stock performance improvements.

Recent financial reports indicate that Intel’s revenue for the third quarter of 2023 reached $16.5 billion, slightly exceeding analysts’ expectations. This is a positive sign, considering the company’s focus on diversifying its product offerings and its commitment to enhancing semiconductor fabrication capabilities. The ongoing transition to advanced process technologies, including 7nm and less, also plays a crucial role in restoring investor confidence.

Factors Influencing Intel Stock

Several factors are influencing Intel’s stock trajectory. Firstly, the global semiconductor shortage has presented both challenges and opportunities; while it strained supply chains, it also highlighted the critical role of semiconductor companies. Intel’s efforts to ramp up production capacity are essential to capitalize on the increased demand.

Moreover, Intel’s competition with other tech giants, particularly AMD and NVIDIA, has intensified, affecting market perceptions and stock valuations. Strategic partnerships and research collaborations in emerging technologies, especially in artificial intelligence and cloud computing, could be pivotal for Intel’s growth prospects.

Conclusion and Future Outlook

In conclusion, Intel’s stock remains a significant player in the technology sector, with its performance being closely monitored by investors. The successful execution of its strategic plans, including investments in cutting-edge technologies and overcoming supply chain challenges, will be vital for its future stock performance. Analysts predict that if Intel continues to innovate and maintain competitive pricing, it could regain its stronghold in the semiconductor market, leading to a potential appreciation in stock value. For investors considering Intel, it is crucial to stay informed about these market dynamics and company developments.