Insights into Royal Bank Stock: Current Trends and Outlook

Introduction

The Royal Bank of Canada (RBC) is one of the largest financial institutions in the country, offering a wide range of financial products and services. Its stock, listed on the Toronto Stock Exchange under the symbol RY, is a significant indicator of the health of the Canadian banking sector. As Canadian investors navigate a period of economic uncertainty, understanding the performance and outlook of RBC stock becomes increasingly important.

Recent Performance

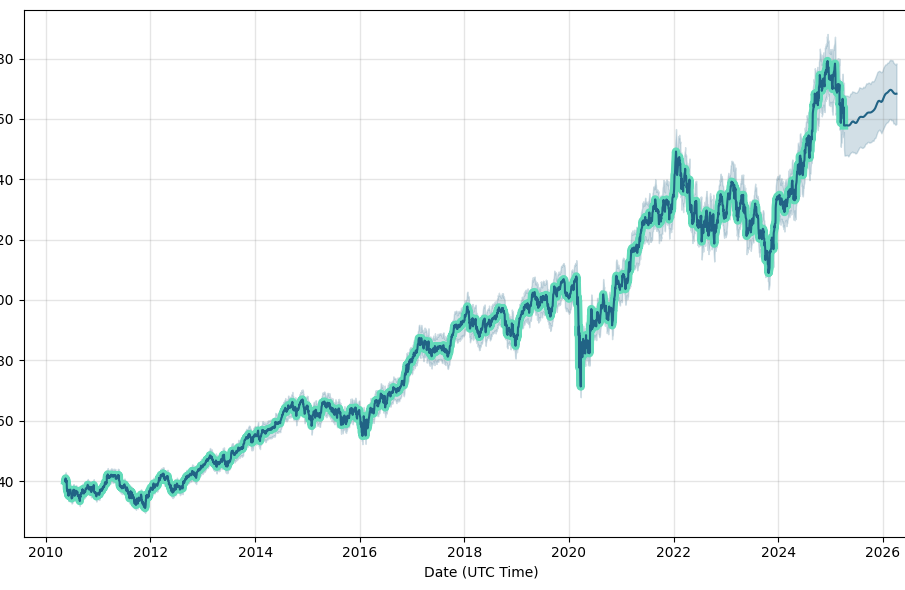

In recent months, RBC stock has shown resilience despite broader market volatility. As of October 2023, the stock price was approximately CAD 138, reflecting a year-to-date growth of around 12%. The bank has reported strong quarterly earnings driven by robust loan growth, strong capital markets performance, and a favorable interest rate environment.

One notable development influencing RBC’s stock was its recent announcement of increased dividends. In September 2023, RBC declared a quarterly dividend of CAD 1.13 per share, an increase of 10% from the previous quarter. This move not only signals the bank’s strong financial position but also enhances its attractiveness to income-seeking investors.

Factors Impacting Stock Performance

Several factors are contributing to the performance of Royal Bank stock. Firstly, Canada’s economic recovery post-COVID-19 has improved lending activity across various sectors, leading to increased revenue for financial institutions. Furthermore, the Bank of Canada has embarked on a tightening monetary policy, raising interest rates to combat inflation, which has benefits for banks in terms of interest income.

Additionally, the rise of digital banking and technological innovation has allowed RBC to enhance its service delivery and efficiency. The bank has invested significantly in cybersecurity and digital platforms, positioning itself competitively in the evolving financial landscape.

Future Outlook

Analysts remain cautiously optimistic about RBC’s stock going into 2024. Although concerns regarding rising inflation and potential recessionary pressures exist, RBC’s strong capital position and diverse revenue streams are expected to support its growth. According to leading market analysts, RBC stock is projected to reach CAD 150 by the end of 2024, making it a favorable consideration for long-term investors.

Conclusion

In summary, Royal Bank stock continues to demonstrate resilience amid challenging economic conditions, supported by strong earnings, dividend growth, and strategic investments in technology. Investors will be closely monitoring RBC’s performance as it navigates potential headwinds in the coming year. With a stable outlook and solid fundamentals, RBC remains a key player in the Canadian financial market.