Hut 8 Stock: Performance Analysis and Investment Outlook

Importance of Hut 8 Stock in the Crypto Market

Hut 8 Mining Corp., one of Canada’s largest cryptocurrency miners, has gained significant attention as the market for digital assets reshapes. As traditional forms of investment face uncertainty, more investors are looking to cryptocurrencies. Understanding the performance and outlook of Hut 8 stock is crucial for those considering entry or expansion into this volatile market.

Recent Developments in Hut 8

As of October 2023, Hut 8 has reported substantial increases in its operational capacity. The company has successfully expanded its Bitcoin mining facilities, achieving an estimated production capacity of 2.2 exahash per second. In Q3 2023, Hut 8 revealed that it mined approximately 360 Bitcoin, boosting its holdings to over 9,000 BTC. This impressive output reflects a strategic alignment with client interests and robust positioning within the competitive landscape.

Stock Performance Metrics

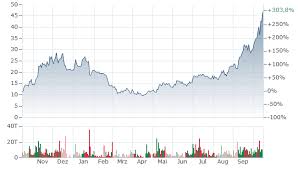

Hut 8 stock, traded on the Toronto Stock Exchange under the ticker symbol HUT, has exhibited fluctuating prices corresponding to the volatile nature of cryptocurrency prices. Over the past year, Hut 8 has seen its stock value rise by over 50%, paralleling the increase in Bitcoin’s market price. Analysts note that while the company is capitalizing on favorable market conditions, investors need to be cautious of market corrections that historically impact crypto-related equities.

Market Challenges and Opportunities

The current economic climate presents both challenges and opportunities for Hut 8. With regulatory scrutiny of cryptocurrency operations increasing and the rising electricity costs impacting profit margins, the company must navigate these hurdles adeptly. Moreover, as more institutions adopt cryptocurrency, opportunities for growth could lead to further stock appreciation.

Conclusion: The Future of Hut 8 Stocks

As we move forward into 2024, the outlook for Hut 8 stocks remains entwined with broader trends in cryptocurrency acceptance and regulatory developments. Investors should keep an eye on company announcements and industry shifts. While challenges exist, Hut 8’s strong operational fundamentals position it favorably against its competitors. In conclusion, whether you’re a seasoned investor or new to the crypto realm, keeping informed about Hut 8 stock’s trajectory could yield insightful perspectives on the emergent crypto investment landscape.