Exploring the NASDAQ Index: Trends and Impact

Introduction

The NASDAQ Index is one of the most significant stock market indices globally, representing a substantial portion of the technology and innovation sectors. With over 3,000 companies listed, it provides a critical insight into the performance of tech-heavy stocks and serves as a barometer for the broader market performance. Understanding movements within the NASDAQ can help investors make informed decisions, especially given its recent volatility influenced by economic factors and global events.

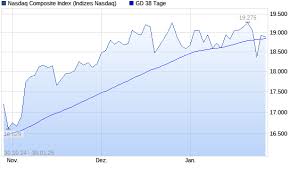

Recent Trends in the NASDAQ Index

As of October 2023, the NASDAQ Index has been experiencing fluctuations due to various factors including interest rate changes, inflation concerns, and geopolitical tensions. In the third quarter of 2023, the index showed signs of recovery after a tumultuous start to the year—rising approximately 12% from its lows in June. Tech giants like Apple, Microsoft, and Tesla played pivotal roles in this rebound, reflecting strong earnings reports that exceeded market expectations.

Moreover, the ongoing debates around artificial intelligence (AI) and its integration across industries have led to increased investor interest in technology stocks, propelling the index higher. Companies that are leveraging AI technologies are seeing sharp rises in stock prices, contributing to the overall health of the NASDAQ.

Impact of Global Factors

Global events, such as changes in U.S. monetary policy and international trade relationships, continue to have a profound impact on the NASDAQ Index. Federal Reserve policies regarding interest rates are particularly influential; recent announcements of potential rate hikes have generated mixed reactions among investors. The tech sector, which often relies on lower borrowing costs for growth investments, has been particularly sensitive to these changes.

Conclusion

Understanding the NASDAQ Index is essential for investors looking to navigate today’s complex economic landscape. With the index showing resilience amid challenges, analysts expect continued volatility driven by external factors like inflation and government policy shifts. However, the ongoing growth of the technology sector suggests that the NASDAQ may continue to outperform other indices in the long run. Investors are advised to stay informed about these developments, as they could significantly influence market dynamics and their investment strategies moving forward.