Exploring the Impact of Scott Bessent in Investment Management

Introduction

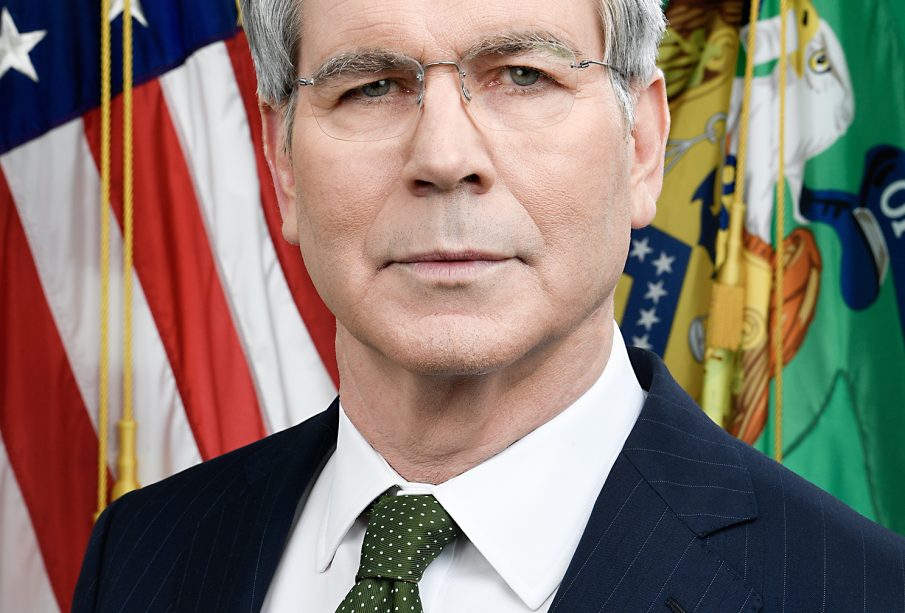

Scott Bessent, a prominent figure in the investment management space, has made significant contributions that resonate beyond Wall Street.

With a career that spans over two decades, primarily as the Chief Investment Officer for George Soros’s family office, Bessent has shaped investment strategies that emphasize risk management and innovation. In recent years, he has turned his focus towards his own firm, Key Square Capital Management, which aims to integrate long-term investment strategies with technology and sustainability practices.

Current Developments

As of October 2023, Bessent has been in the spotlight due to the increasing challenges posed by market volatility and economic uncertainty. His approach has been to leverage macroeconomic insights and advanced analytical tools to navigate these turbulent waters.

Key Square Capital, which he co-founded in 2017, has seen remarkable growth, attracting substantial investor interest. According to reports from Bloomberg, the firm currently manages several billion dollars in assets, focusing on liquid alternatives and event-driven strategies that provide a tailored approach to asset allocation.

Recent Market Influence

Bessent’s strategic insights have made him a sought-after speaker at investment conferences. He recently spoke at the 2023 Institutional Investor Conference, where he emphasized the importance of adapting investment strategies in response to rising interest rates and geopolitical tensions.

Moreover, Bessent has introduced innovative investment vehicles that appeal to a wider range of investors. In a recent interview, he mentioned the growing importance of ESG (Environmental, Social, Governance) factors in investment decisions, hinting at a future where social responsibility and profitability go hand in hand.

Conclusion

Scott Bessent’s influence in the investment management sector cannot be understated. As he navigates the evolving landscape of financial markets, his strategies and insights will likely set benchmarks for both established and emerging investment firms.

With a commitment to innovation and sustainability, Bessent represents a new wave of investment leaders that balance profit with responsibility. Investors and institutions would do well to pay attention to his moves, as they may outline the future trajectories of the financial industry in the years to come.