Exploring SQQQ: The Inverse ETF on The NASDAQ-100

Understanding SQQQ and Its Relevance

The ProShares UltraPro Short QQQ, commonly referred to by its ticker symbol SQQQ, is an inverse exchange-traded fund (ETF) designed to provide triple the inverse daily performance of the NASDAQ-100 Index. This means that if the NASDAQ-100 declines by 1% in a day, SQQQ is intended to rise by approximately 3%. This structure makes SQQQ a popular tool among traders looking to hedge against downturns in tech-heavy stocks or to capitalize on short-term movements in the market.

Recent Market Context

As of early October 2023, the markets have experienced increased volatility due to concerns over inflation, interest rate hikes, and geopolitical tensions. This has resulted in fluctuating performance in technology stocks, which are predominantly represented in the NASDAQ-100. The demand for inverse ETFs like SQQQ has consequently surged, as investors look for ways to protect their portfolios against potential downturns.

In recent weeks, SQQQ has seen increased trading volume, reflecting heightened interest amongst traders. According to data from financial analytics platforms, SQQQ has recorded an increase in its assets under management by nearly 30% since the beginning of September 2023, indicating a growing preference for hedging strategies among investors.

Strategic Considerations for Investors

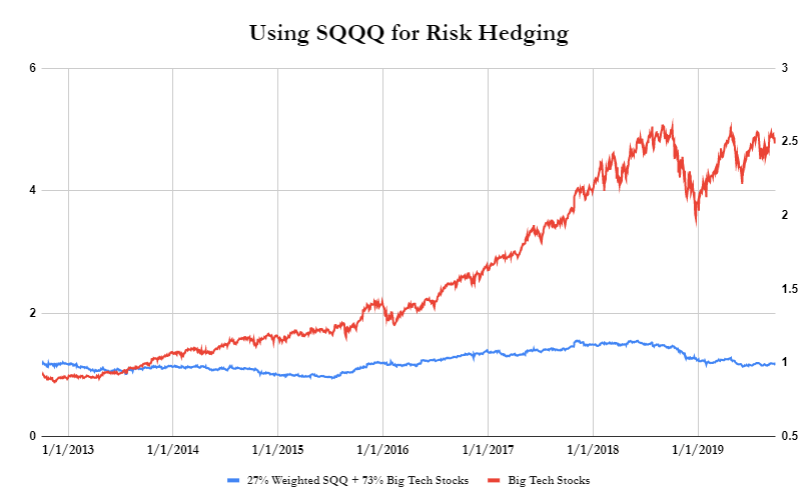

While SQQQ can provide significant returns over short periods, it’s important for investors to understand the inherent risks involved in trading leveraged ETFs. These products aim to achieve their investment objectives on a daily basis, and their performance can deviate significantly from the market index over longer time frames due to the effects of compounding. Financial experts often advise that SQQQ is most suitable for experienced traders who are capable of closely monitoring the market and are looking to adopt aggressive trading strategies.

Conclusion: Future Outlook for SQQQ

As we move into the final quarter of 2023, the outlook for SQQQ will largely depend on macroeconomic factors including interest rates and the performance of technology stocks. With analysts predicting continued volatility in the markets, SQQQ may remain a crucial component for traders looking to benefit from market declines or hedge their positions. Investors should keep abreast of economic indicators and consider their personal risk tolerance before venturing into this leveraged financial instrument.