Exploring SQQQ: The Inverse ETF for Today’s Investors

Introduction

As stock market volatility increases, many investors are exploring various strategies to protect their portfolios. One popular instrument in this arena is the ProShares UltraPro Short QQQ ETF, commonly known as SQQQ. This exchange-traded fund (ETF) aims to provide three times the inverse daily performance of the Nasdaq-100 Index. Understanding SQQQ’s mechanics and its relevance can help investors make informed decisions, particularly in bear markets.

What is SQQQ?

SQQQ is designed for investors seeking to hedge against potential downturns in the technology-heavy Nasdaq-100 Index. Since its inception, SQQQ has drawn interest due to its potential for high returns in bearish markets. However, it is essential to note that such funds can also carry substantial risk, as their leverage means both gains and losses can be significant.

Recent Market Context

In recent months, the tech sector has witnessed considerable fluctuations, mainly due to interest rate hikes and ongoing economic uncertainties. As the Federal Reserve continues to tighten monetary policy, growth stocks, which dominate the Nasdaq-100, are under pressure, making SQQQ increasingly attractive to risk-averse investors. For example, during the market volatility observed in early 2023, SQQQ witnessed elevated trading volumes as investors attempted to capitalize on short-term price movements.

Strategies for Using SQQQ

Investors using SQQQ can adopt various strategies, including:

- Hedging: Investors can use SQQQ to safeguard their long positions in tech stocks against potential downturns.

- Short-term Trading: Due to the leveraged nature of SQQQ, some traders actively engage in short-term trading, buying and selling based on market trends.

- Speculation: Investors may speculate on market declines by holding SQQQ in anticipation of economic downturns or unfavorable market conditions.

Risks and Considerations

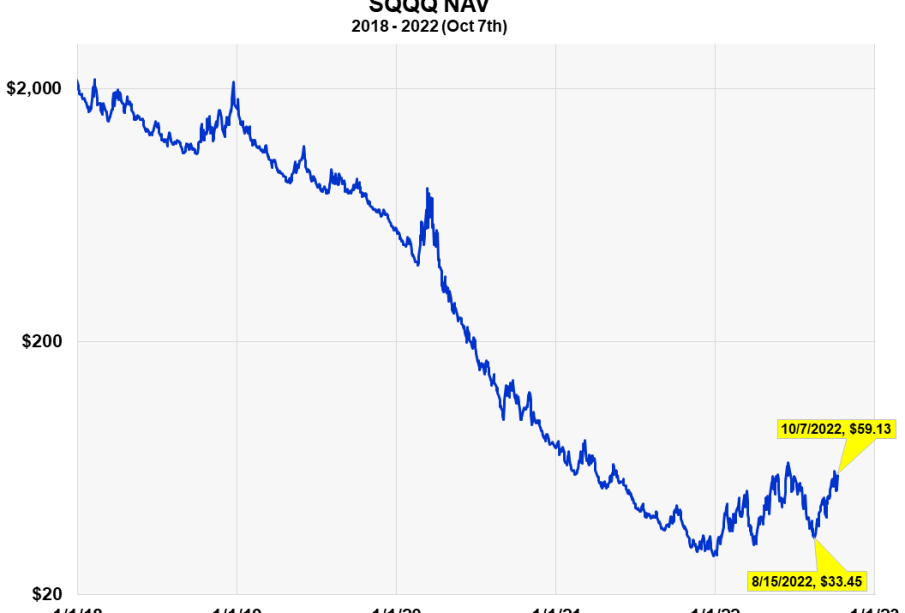

While SQQQ offers enticing opportunities, it is crucial to recognize the risks associated with leveraged ETFs. The fund is designed for daily use, which means it may not perform as expected over longer time frames due to compounding effects. Investors should carefully consider their risk tolerance and investment horizon before incorporating SQQQ into their portfolios.

Conclusion

SQQQ serves as a powerful tool for investors looking to navigate the complexities of the current market landscape. As economic conditions continue to unfold, understanding SQQQ’s mechanics and applications can help investors hedge against potential declines in the tech sector. Its significance in investment strategies cannot be overstated, especially during periods of pronounced market volatility. As always, investors should do their due diligence and consider their financial goals and risk profiles when using leveraged products like SQQQ.