Everything You Need to Know About Revenue Canada

Introduction

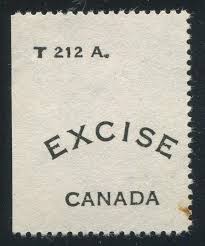

Revenue Canada, formally known as the Canada Revenue Agency (CRA), plays a crucial role in the Canadian economy by administering tax laws and ensuring that citizens comply with their tax obligations. Understanding its function is vital for both individuals and businesses, as it impacts financial decisions and government services funded through taxation.

What is Revenue Canada?

Established in 1999, Revenue Canada is responsible for the administration and enforcement of the Income Tax Act, as well as the Goods and Services Tax (GST) and the Harmonized Sales Tax (HST). The agency collects taxes which are then allocated to various public services including healthcare, infrastructure, and education, significantly influencing the economic landscape of Canada.

Recent Developments

In recent years, Revenue Canada has focused on improving compliance and reducing tax evasion. The CRA has introduced several initiatives aimed at educating taxpayers about their responsibilities and simplifying the filing process. Recently, the agency announced a campaign targeting offshore tax evasion, which could recover millions of dollars that should be contributing to the national economy.

Challenges Faced

However, Revenue Canada also faces challenges. The ongoing evolution of digital finance and cryptocurrencies presents new hurdles in tax compliance. Moreover, the COVID-19 pandemic has complicated the agency’s operations, leading to significant delays in processing tax returns and responding to taxpayer inquiries. The CRA has implemented various relief measures, including extended deadlines and assistance programs, to support Canadians during these difficult times.

Conclusion

In conclusion, Revenue Canada is not just a tax collector; it is an essential institution that underpins the economic framework of the country. As Canadians navigate their financial responsibilities, awareness of CRA’s operations and initiatives is necessary for compliance and optimal financial management. Looking ahead, the agency is expected to continue adapting to emerging economic trends and technological changes, ensuring its services remain relevant and efficient. Understanding Revenue Canada will be pivotal for Canadians as they engage with their tax obligations in this ever-evolving landscape.