Enhancing CIBC Customer Experience: Latest Developments

Introduction

Customer experience has become a cornerstone for financial institutions, and Canadian Imperial Bank of Commerce (CIBC) is no exception. As one of Canada’s largest banks, CIBC continually innovates and enhances its services to ensure customer satisfaction. This article explores recent initiatives by CIBC that highlight their commitment to improving the customer experience.

Recent Initiatives

In recent months, CIBC has implemented several new features aimed at enhancing the customer experience. One of the most notable developments is the integration of AI-driven chatbots in their customer service operations. Launched in August 2023, these chatbots are designed to respond to customer inquiries in real-time, providing instant solutions and reducing wait times. According to the bank, the chatbots can handle up to 70% of common customer queries, allowing human agents to focus on more complex issues.

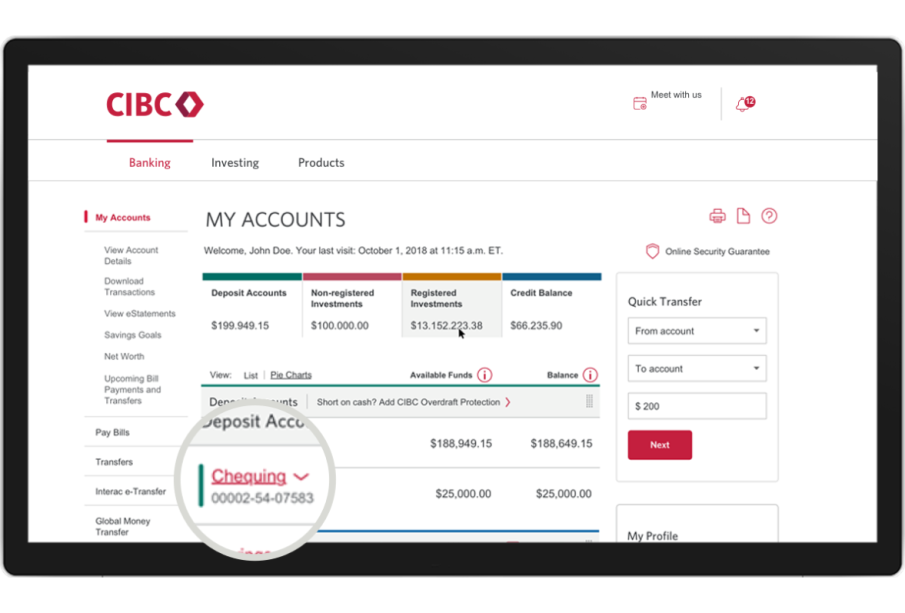

Another significant initiative is the enhancement of their mobile banking app. In July 2023, CIBC introduced new functionalities such as personalized financial advice and budgeting tools. These features leverage user data to provide tailored recommendations, making it easier for customers to manage their finances. Feedback from users has been overwhelmingly positive, with many noting improved usability and satisfaction rates.

Focus on Accessibility

CIBC is also committed to promoting financial inclusion and accessibility for all customers. In September 2023, the bank announced partnerships with community organizations to better serve individuals with disabilities. This initiative includes specialized training for staff to assist customers more effectively and ensure that all banking experiences are as smooth and accessible as possible.

Conclusion

CIBC’s dedication to enhancing customer service demonstrates its understanding of the ever-evolving financial landscape. By implementing AI technology, upgrading their mobile app, and focusing on accessibility, CIBC aims to meet the diverse needs of its clientele. As consumer expectations continue to rise, the bank’s proactive approach is likely to position them favorably in the highly competitive banking sector. Looking ahead, the expectation is that CIBC will continue to adapt and innovate, ensuring that customer satisfaction remains a top priority.