Dollarama Stock: Current Performance and Market Outlook

Introduction

Dollarama Inc. (TSX: DOL) has become a focal point for investors seeking stable growth in the Canadian retail sector. Known for its variety of discounted goods, Dollarama has thrived in a competitive market, especially during economic downturns when consumers seek value. Following a tumultuous few years due to global economic challenges, insights into Dollarama’s stock performance are particularly relevant for both seasoned and novice investors alike.

Current Market Overview

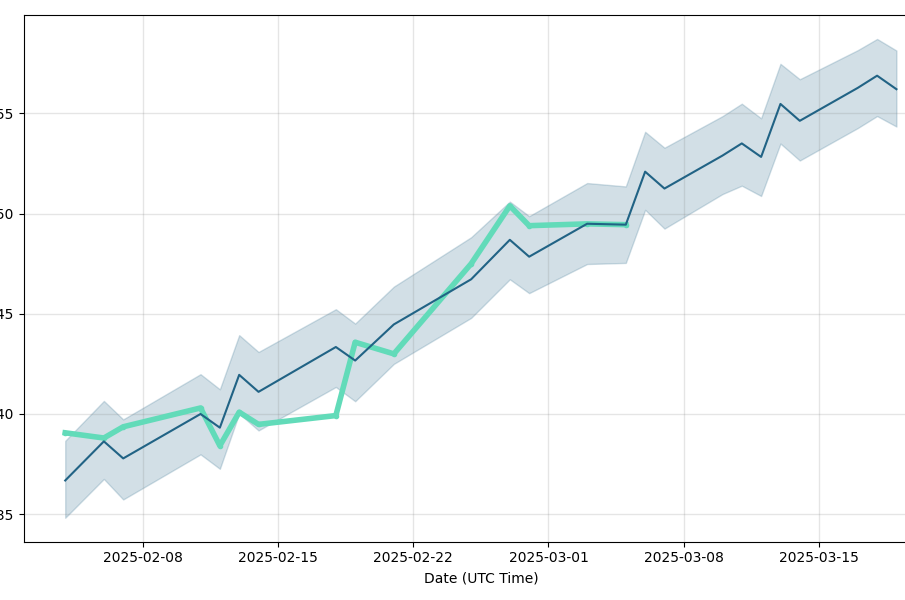

As of October 2023, Dollarama’s stock has shown a promising upward trend, closing at approximately CAD 89.50 per share. This marks a notable increase of over 20% year-to-date, reflecting strong quarterly earnings reports. In August 2023, the company reported a net income increase of 15%, bolstered by increased consumer traffic and a resilient business model. Analysts attribute this growth not only to an expanded product line but also to strategic store openings, which now number over 1,500 across Canada.

Factors Influencing Dollarama Stock

Several key factors have contributed to the current performance of Dollarama stock:

- Consumer Demand: Economic fluctuations often lead consumers to seek budget-friendly options, with Dollarama benefiting from this trend.

- Expansion Strategy: The company has aggressive plans for expanding its store footprint, particularly in rural areas, tapping into underserved markets.

- Operational Efficiency: Operational innovations, including supply chain improvements and inventory management, have enhanced profitability.

Outlook and Future Predictions

Market analysts remain optimistic about the future of Dollarama stock. Projections suggest that the company could see continued growth as it explores e-commerce opportunities and enhances its product offerings. Furthermore, with inflation persisting in various sectors, Dollarama’s value proposition remains compelling. Experts predict that if the company can maintain current momentum and adapt to consumer needs, share prices could rise to CAD 100 within the next 12 months.

Conclusion

Dollarama stock presents a notable investment opportunity as it continues to demonstrate resilience and growth potential. With a strong brand presence and strategic expansion plans, investors might find it a suitable option for their portfolios. Keeping an eye on economic trends and Dollarama’s adaptive strategies will be crucial for assessing long-term value in this market segment. For those considering entry into the stock, it may be worth watching the company’s quarterly performance and industry developments closely.