Current Trends in WTI Oil Price and Their Economic Impact

Introduction

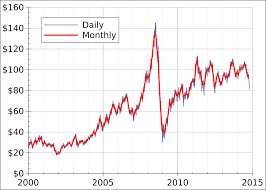

The price of West Texas Intermediate (WTI) oil is a critical indicator of the health and trends in the global energy market. As the U.S. benchmark for crude oil, fluctuations in the WTI oil price can significantly influence economies worldwide, impacting everything from fuel prices at the pump to consumer spending and inflation rates. Understanding the current trends in WTI pricing is essential for investors, policymakers, and consumers alike.

Recent Developments in WTI Oil Prices

As of late October 2023, WTI oil prices have been experiencing notable volatility. After trading as low as $70 per barrel in early October, prices surged to approximately $85 per barrel by mid-month as a result of factors including geopolitical tensions in the Middle East and increased demand forecasts from major economies. The ongoing conflict in Ukraine and potential sanctions on Russian oil continue to create uncertainties in supply, further driving prices upward.

Additionally, OPEC+ has maintained production cuts, reinforcing higher prices despite calls from consuming nations for increased output to alleviate rising fuel costs. Despite a cooling global economy, the energy sector remains resilient, influenced by sustained demand recovery as countries transition away from pandemic restrictions.

Factors Influencing WTI Oil Prices

Several factors contribute to the fluctuations observed in WTI oil prices:

- Geopolitical Stability: Crises in oil-producing regions can disrupt supply chains and lead to rapid price increases.

- Market Sentiment: Speculation by traders on future economic conditions can lead to significant short-term movements in oil prices.

- OPEC+ Policies: Decisions made by OPEC+ regarding production levels can have a widespread impact on the global oil supply and pricing.

- Economic Indicators: Indicators such as U.S. employment rates, manufacturing output, and consumer confidence can suggest increasing or decreasing oil demand.

Conclusion

In summary, the WTI oil price is influenced by a complex interplay of geopolitical, economic, and market factors that can cause rapid shifts. As we look ahead, analysts predict that oil prices may remain elevated into 2024, particularly if geopolitical tensions persist or global demand continues to recover. For consumers and businesses, monitoring these trends is vital for making informed financial decisions. Understanding WTI oil price movements is not just crucial for those in the energy sector, but for anyone looking to navigate the broader economic landscape impacted by these fluctuations.