Current Trends in the TSX Index and Their Impact on Investors

Introduction

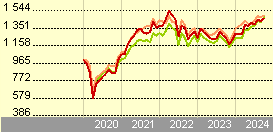

The Toronto Stock Exchange (TSX) Index is a vital component of Canada’s economic landscape, representing the performance of the country’s major publicly traded companies. As a crucial benchmark for Canadian equities, understanding the TSX Index is essential for investors and industry analysts. Recent fluctuations in the index reflect broader market trends, economic conditions, and investor sentiment both in Canada and globally.

Recent Performance of the TSX Index

As of early November 2023, the TSX Index has shown notable resilience amid economic uncertainties. The index closed at 21,400 points, reflecting a year-to-date increase of approximately 8%. Key sectors driving this performance include energy, materials, and financials, which have rebounded strongly from earlier market volatility. Analysts attribute this growth to a combination of rising commodity prices and a robust labor market, which have positively influenced investor confidence.

Key Influencing Factors

1. **Commodity Prices**: With Canada being one of the world’s largest producers of natural resources, fluctuations in oil and metals prices significantly affect the TSX Index. Recently, oil prices surged due to geopolitical tensions and supply chain disruptions, benefiting energy stocks within the index.

2. **Interest Rates**: The Bank of Canada (BoC) has maintained its overnight rate at 5% to combat inflation and stabilize the economy. This provides both challenges and opportunities for sectors represented in the TSX Index as businesses adjust to increased borrowing costs while navigating consumer demand shifts.

3. **Global Economic Climate**: The ongoing recovery from the pandemic and political tensions in various regions also play a defining role in market performance. Changes in U.S. monetary policy and its implications for global markets are continuously monitored by Canadian investors.

Conclusion

The TSX Index remains a key barometer for gauging the health of Canada’s economy. Its performance is indicative of broader economic trends and influences investment strategies across various sectors. As we move into 2024, investors are advised to stay vigilant regarding external factors that could impact the market, including interest rate adjustments and geopolitical events. Understanding the dynamics at play in the TSX Index not only equips investors with necessary insights but also helps them make informed decisions in a rapidly shifting financial landscape.