Current Trends in Ethereum Price USD

Introduction

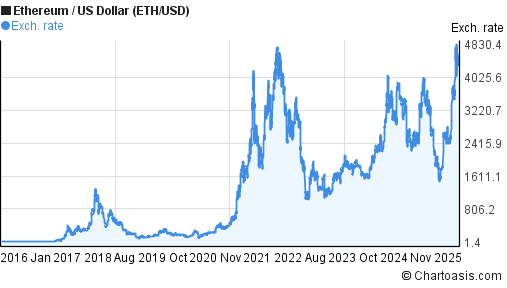

Ethereum, the second-largest cryptocurrency by market capitalization, has been a focal point for investors and traders alike due to its significant price fluctuations. Understanding the factors that influence Ethereum’s price in USD is essential for anyone interested in cryptocurrency markets. As of October 2023, Ethereum’s price has demonstrated notable volatility, influenced by both market sentiment and broader economic developments.

Recent Price Movements

As of October 5, 2023, the price of Ethereum stands at approximately $1,800 USD, experiencing a slight increase of 3% over the past week. This uptick follows a challenging month where prices dipped to around $1,600 USD, driven primarily by market corrections related to monetary policy changes and tightening regulations around cryptocurrencies. Traders have responded positively to recent institutional interest, with companies showing renewed interest after a summer slowdown.

Factors Influencing Price

Several key factors affect the price of Ethereum in USD. Firstly, the overall cryptocurrency market trends and Bitcoin’s performance often set the tone for investor sentiment. Bitcoin’s rally earlier in the month has led to a wave of investments into altcoins, including Ethereum. Secondly, the developments in the Ethereum protocol itself, such as updates related to scalability and sustainability, significantly impact market perception. The anticipated Ethereum 2.0 upgrade is also influencing investor confidence as it promises to improve transaction speeds and reduce energy consumption.

Market Sentiment and Future Outlook

Market sentiment remains cautiously optimistic, with analysts projecting Ethereum could see prices range between $1,800 and $2,200 USD in the coming weeks, depending on macroeconomic indicators and investor behavior. The Ethereum community is closely monitoring regulatory developments, as any new regulations could have substantial impacts on the market. Additionally, the adoption of decentralized finance (DeFi) applications and non-fungible tokens (NFTs) built on Ethereum continues to grow, which may further bolster demand for ETH, thereby influencing its price in USD.

Conclusion

In summary, the current price of Ethereum in USD reflects a complex interplay of market dynamics and underlying technological advancements. Investors need to stay informed about both the short-term fluctuations and long-term viability of Ethereum as it continues to evolve. With increasing adoption rates and ongoing developments in the Ethereum network, the price outlook remains a topic of interest for both seasoned traders and newcomers in the cryptocurrency landscape.