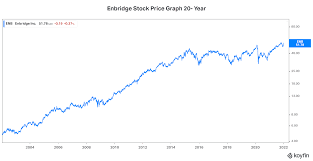

Current Trends in Enbridge Stock Performance

The Importance of Enbridge Stock

Enbridge Inc. (NYSE: ENB) is one of the largest infrastructure companies in North America, specializing in energy transportation and distribution. The company plays a vital role in the energy sector, making its stock a focal point for investors looking at energy assets. As global energy demands rise and fall, keeping an eye on Enbridge stock provides insight into market trends and the overall economic climate.

Recent Performance Analysis

As of October 2023, Enbridge’s stock has experienced fluctuations due to several factors, including regulatory changes, geopolitical tensions affecting oil and gas markets, and shifts in renewable energy investments. Over the past month, the stock has seen an increase of approximately 5%, largely attributed to rising oil prices and a positive earnings report that outperformed analysts’ expectations.

On September 29, 2023, Enbridge reported a third-quarter profit of $1.6 billion, a significant increase from the previous year. This performance highlights the company’s effective management of its asset base, which includes extensive pipeline systems transporting a substantial portion of North America’s oil and natural gas.

Factors Impacting Enbridge Stock

External factors such as OPEC production decisions and U.S. shale output continue to exert influence over stock movements. Additionally, Enbridge’s commitment to reducing its carbon footprint by investing in renewable energy pipelines is noteworthy. The company aims to achieve a significant reduction in its greenhouse gas emissions by 2030, which may attract more environmentally-conscious investors and potentially stabilize stock prices in a fluctuating market.

Looking Ahead

Analysts project moderate growth for Enbridge stock in the coming months, primarily driven by developments in energy infrastructure investments and continued global demand for energy. However, external shocks—a common occurrence in the energy sector—could pose risks. Investors are advised to stay informed about market trends and company financial health, focusing on Enbridge’s long-term strategies to navigate these challenges.

Conclusion: Significance for Investors

Enbridge stock remains a key player in the energy market, with its performance reflecting broader economic trends. As the company adapts to an evolving energy landscape, it offers insights into investment opportunities in both traditional and renewable sectors. Potential investors should consider market conditions, regulatory frameworks, and the company’s sustainability efforts when evaluating Enbridge stock for their portfolios.