Current Trends in Dow Futures and Market Outlook

Understanding Dow Futures

Dow futures are essential indicators for investors and analysts, representing the expected performance of the Dow Jones Industrial Average (DJIA) before the stock market opens. As the DJIA is a key measure of the U.S. economy’s health, tracking Dow futures is vital for anticipating market movements and making informed investment decisions.

Recent Trends in Dow Futures

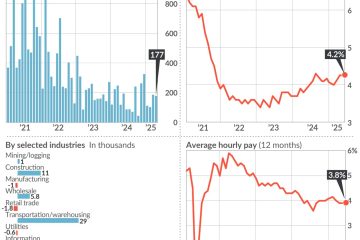

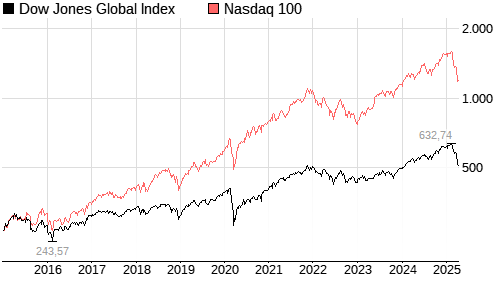

As of late October 2023, Dow futures have shown significant fluctuations, responding to a mix of economic data and geopolitical events. In the past week, futures dipped following disappointing manufacturing data, highlighting concerns about an economic slowdown. Investors are now closely monitoring inflation rates and Federal Reserve policies, which directly impact market sentiment.

Key Influencing Factors

Several factors influence Dow futures:

- Economic Reports: Key economic indicators such as employment figures, consumer spending, and manufacturing outputs provide insight into U.S. economic health.

- Geopolitical Events: Recent tensions in global trade and conflicts have also created volatility in the futures market, impacting investor confidence.

- Federal Reserve Policy: Changes in interest rates and monetary policy by the Federal Reserve directly influence market predictions and futures pricing.

Current Market Sentiment

Recent surveys indicate that investor sentiment is somewhat cautious. Despite a relatively strong labor market, concerns over inflation and potential interest rate hikes have led to mixed feelings about economic growth. Analysts predict that Dow futures may continue to reflect this uncertainty in the upcoming days.

Conclusion: Looking Ahead

As investors watch the Dow futures, it is essential to remain vigilant regarding economic indicators and geopolitical developments. Experts forecast that the market may experience continued volatility in the short term as it reacts to upcoming economic reports and Fed announcements. For investors, staying informed and prepared for shifts in market sentiment is crucial for navigating these turbulent times.