Current Trends and Performance of BABA Stock

Introduction

BABA stock, the ticker symbol for Alibaba Group Holding Limited, remains a focal point of interest for investors globally. As a leader in the Chinese e-commerce market, Alibaba’s stock performance offers insights into China’s digital economy and regulatory landscape. Recent fluctuations in BABA stock have prompted significant analysis, making this a timely topic for investors looking to understand current market dynamics.

Recent Developments

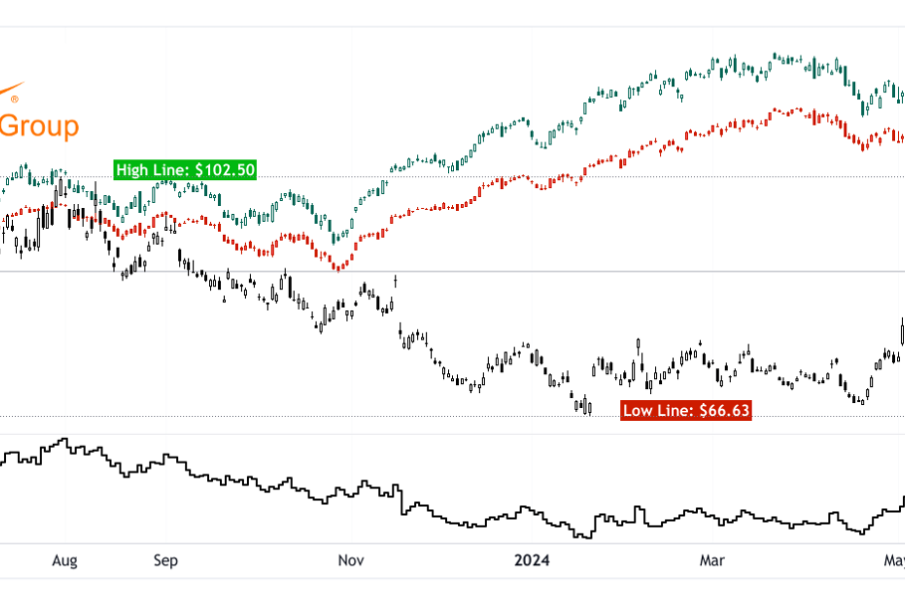

As of mid-October 2023, BABA stock has experienced notable volatility, reflecting broader market trends as well as specific company challenges. Following a prolonged period of underperformance due to regulatory crackdowns by the Chinese government, BABA stock showed signs of recovery after the company reported better-than-expected earnings in its latest quarterly results. The earnings report revealed a year-over-year revenue increase of 7%, defying analysts’ expectations amidst economic uncertainties.

Notably, Alibaba also announced strategic shifts in its business model, emphasizing its cloud computing services and international expansion efforts. This diversification strategy has resonated positively with investors, leading to a modest increase in stock price since its dip earlier in the year.

Market Sentiment and Investor Outlook

Investor sentiment towards BABA stock is mixed, reflecting concerns over ongoing regulatory risks in China and the overall global economic climate. Analysts forecast that BABA’s journey will be shaped by a combination of its ability to navigate regulatory landscapes and its strategic pivots in technology and international markets.

Some analysts project that if Alibaba can continue to demonstrate growth in its cloud services and adapt to new consumer behaviors post-pandemic, the stock may stabilize and potentially appreciate in value. Conversely, lingering geopolitical tensions and economic slowdowns in China pose substantial risks to its growth trajectory.

Conclusion

The significance of BABA stock extends beyond Alibaba Group itself, highlighting the intricate connections in the global economy and the impact of regulatory policies. For Canadian investors, understanding the dynamics of BABA stock can help inform diversification strategies within their portfolios. As the company continues to adapt, monitoring its performance will be crucial. Investors should remain cautiously optimistic, balancing potential rewards against associated risks in a volatile market.