Current Trends and Insights on Tesla Bourse

Introduction to Tesla Bourse

The stock market performance of Tesla, Inc., often referred to as the Tesla Bourse, has become a focal point for investors worldwide. Tesla’s innovative approach to electric vehicles and renewable energy solutions has led to a substantial impact on financial markets. As the leading company in electric vehicles, understanding Tesla’s market behavior is crucial for investors, analysts, and industry enthusiasts alike.

Recent Market Developments

As of October 2023, Tesla’s stock price has shown volatility driven by both external economic factors and company-specific news. Following reports of increased production rates in their Gigafactories, Tesla’s stock surged by approximately 15%, reflecting investor optimism about future earnings. Furthermore, partnerships with major battery suppliers and advancements in autonomous driving technologies have bolstered investor confidence, leading to positive buzz in financial news outlets.

Challenges Ahead

Despite the optimistic trends, Tesla faces significant challenges. One of the key issues is the growing competition from traditional automakers and new entrants in the electric vehicle market. Companies like Ford and General Motors are ramping up their production of electric vehicles, which could potentially affect Tesla’s market share. Additionally, concerns around battery supply chains and raw material shortages could pose long-term risks to Tesla’s operational capabilities.

Analyst Forecasts

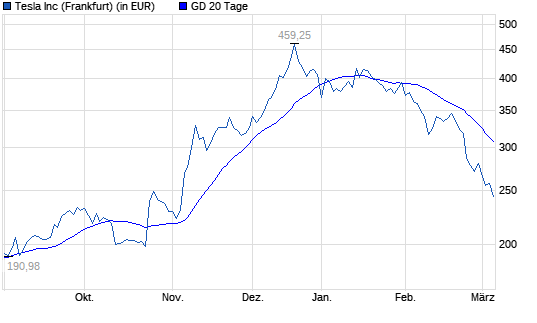

Financial analysts are closely monitoring Tesla’s performance in the coming quarters. Many predict that the recent increase in production and sales will continue to drive stock performance positively. Analysts from major financial institutions have varying predictions for Tesla’s stock price, with estimates ranging from $250 to $400 by the end of 2024, depending significantly on the broader macroeconomic factors and Tesla’s ability to innovate and maintain its market-leading position.

Conclusion

The Tesla Bourse continues to captivate investors with its mix of innovation, market challenges, and economic influences. As the electric vehicle sector expands, keeping an eye on Tesla’s market strategy and performance will be vital for investment decisions. For readers considering investing in Tesla, understanding these dynamics is essential to navigate potential risks and rewards effectively.