Current Trends and Insights on Enbridge Stock

Introduction

Enbridge Inc., one of Canada’s leading energy infrastructure companies, primarily focuses on the transportation of crude oil and natural gas. As the energy sector continues to evolve, understanding Enbridge stock has become crucial for investors, especially considering the geopolitical events and market fluctuations impacting the energy landscape. This article delves into the recent performance and outlook for Enbridge stock, providing valuable insights for current and prospective investors.

Recent Performance of Enbridge Stock

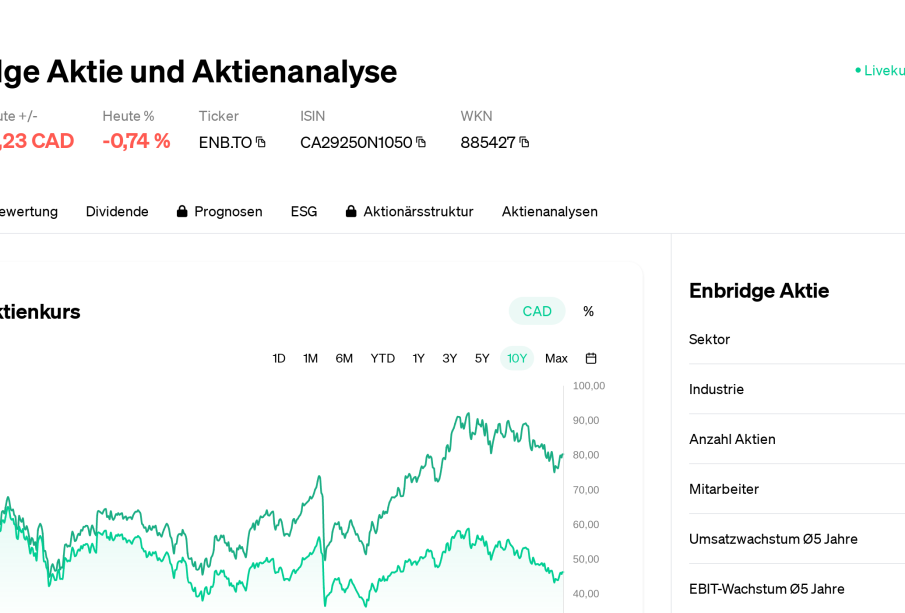

As of October 2023, Enbridge’s stock has demonstrated resilience amidst challenges in the energy sector, reflecting a robust business model and strategic initiatives aimed at sustainability. The stock price has seen fluctuations typical of the energy market, influenced by factors such as global oil prices, regulatory changes, and market demand for renewable energy sources.

In the last quarter, Enbridge announced significant investments in its renewable energy projects, contributing to positive sentiment among investors. Reports suggest that the stock has seen a rise of approximately 10% in the past month, attributed to stronger than expected earnings and optimistic future guidance from the company. Furthermore, Enbridge’s consistent dividend payouts make it an attractive option for income-seeking investors, with a current yield of around 7%.

Market Influences

The broader context of energy prices, particularly crude oil and natural gas, continues to play a critical role in determining the stock’s trajectory. Recent geopolitical conflicts, such as tensions in Eastern Europe and OPEC+ production decisions, have created uncertain scenarios that can lead either to potential profit for Enbridge or underlying risks.

Additionally, the push towards decarbonization and sustainability has prompted Enbridge to diversify its operations, shifting some focus towards renewable energy investments. Analysts suggest that this pivot could open new revenue streams and potentially cushion the stock against traditional energy volatility in the long run.

Conclusion and Forecast

In conclusion, Enbridge stock remains a compelling option amidst ongoing market dynamics. While external factors exert influence, the company’s strategic direction towards renewable energy and consistent financial performance presents a potentially favorable outlook. Investors should continue to monitor developments within the energy sector and the company’s approach to innovation and sustainability.

As energy markets evolve, the need for resilient companies like Enbridge will likely grow, and by capitalizing on new opportunities, Enbridge seemingly positions itself for solid long-term growth, making its stock one worth watching closely.