Current Trends and Future Outlook for ISRG Stock

Introduction

As a leading name in the medical technology industry, Intuitive Surgical, Inc. (ISRG) has garnered attention among investors and analysts alike. The company’s specialty in robotic-assisted surgery technology positions it as a crucial player within the broader healthcare sector, making ISRG stock a significant subject of interest. Understanding its current performance and future potential is vital for both investors and healthcare professionals.

Current Market Performance

As of mid-October 2023, ISRG stock has shown impressive resilience despite broader market fluctuations. Trading at approximately CAD 500, the stock has climbed by about 15% since the start of the year. Analysts credit this growth to strong quarterly earnings, which surpassed projections, and a surge in demand for surgical robotics as hospitals increasingly adopt advanced technologies to improve patient outcomes.

Recent Developments

In a recent press release, Intuitive Surgical reported a revenue increase of 16% year-over-year in Q3, driven largely by a higher volume of procedures utilizing its Da Vinci Surgical Systems. The company also announced the expansion of its product line, introducing new robotic systems tailored for various surgical markets. These developments have solidified ISRG’s position in the market, potentially driving further stock price appreciation.

Market Expertise and Analysis

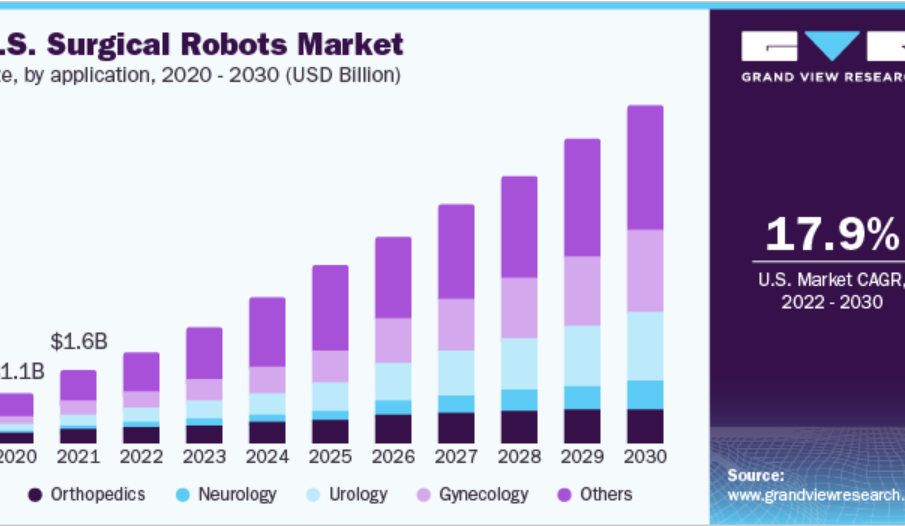

Industry analysts remain optimistic about ISRG’s long-term prospects. According to a report from Morningstar, the medical robotics market is set to grow by over 20% annually, with ISRG poised to capture a significant share of this growth given its established reputation and ongoing innovation. Investors are encouraged to consider these factors when evaluating ISRG stock as part of a diversified portfolio.

Conclusion

In summary, ISRG stock has shown robust performance supported by strong earnings and innovation in surgical technology. Its prospects appear strong as the demand for robotic-assisted surgeries continues to rise. For investors, tracking the company’s strategic expansions and market trends will be critical in making informed decisions regarding ISRG stock. As healthcare technology evolves, positioning within this advancing sector could yield substantial returns.