Current Trends and Future Forecasts for Gold Prices in 2023

Introduction

The price of gold is a critical indicator of economic stability and investor confidence, making it a topic of significant interest in 2023. Historically viewed as a safe haven during times of economic uncertainty, fluctuations in gold prices directly impact markets, investments, and consumers. As global economies grapple with inflation and geopolitical tensions, understanding gold price trends becomes essential for both investors and general consumers.

Current Trends in Gold Prices

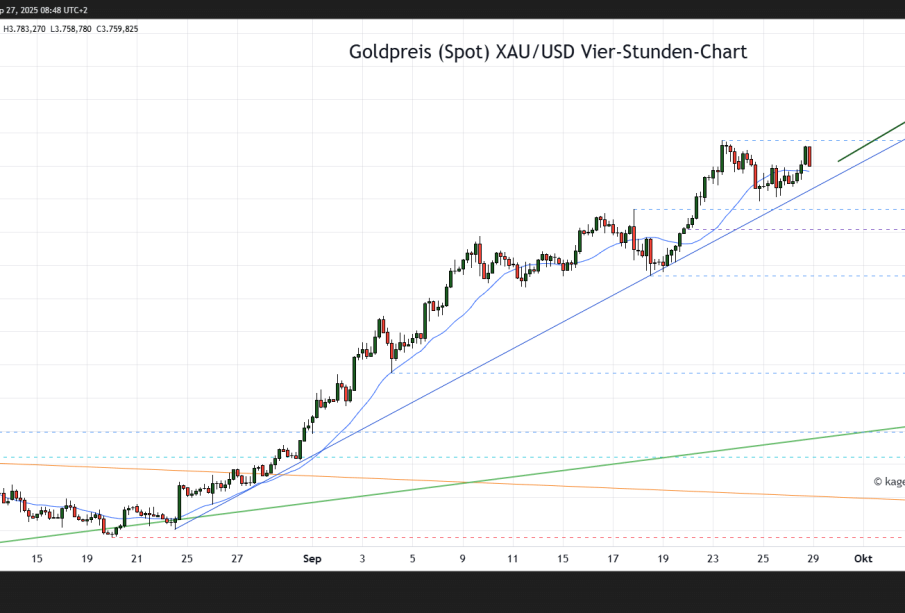

As of late October 2023, gold prices have demonstrated remarkable volatility, fluctuating between USD 1,770 and USD 1,920 per ounce. Analysts attribute these fluctuations to several key factors, including rising inflation rates, fluctuations in the US dollar, and ongoing geopolitical tensions stemming from conflicts in various regions. Notably, as interest rates continue to rise globally, the opportunity cost of holding non-yielding gold increases, which tends to exert downward pressure on prices.

Impact of Economic Conditions

Recent economic data reveals that key players like the United States Federal Reserve are implementing monetary policies that affect gold prices. With signs of inflation becoming persistent, many investors are flocking to gold as a hedge against currency devaluation. In fact, gold prices saw a slight uptick in early October as inflation data suggested that consumer prices in the US rose more than anticipated. Additionally, as central banks around the world continue to stockpile gold, confidence in its long-term value remains intact, providing further supports for prices.

Future Forecasts

Looking ahead, analysts predict that gold prices may reach between USD 1,900 and USD 2,200 per ounce by the end of 2023, depending on various economic indicators such as interest rates, inflation forecasts, and global stability. Analysts from banks like UBS and Goldman Sachs highlight that sustained demand from both investors and central banks could bolster gold prices in the coming months, especially if global economic conditions remain uncertain.

Conclusion

In conclusion, gold prices in 2023 present a complex picture influenced by numerous factors including geopolitical developments, inflation trends, and monetary policy shifts. For investors, understanding these dynamics is vital for making informed decisions. As events unfold, keeping a close watch on gold prices could provide significant opportunities or risks, especially in a continually volatile market. Ultimately, whether for investment or as a hedge against inflation, gold’s role in financial planning and strategy remains crucial.