Current Trends and Analysis of TTD Stock

Introduction

The stock market is a dynamic entity, influenced by numerous factors including company performance, technological advancements, and broader economic indicators. Among the stocks that have garnered substantial attention recently is The Trade Desk, Inc. (TTD), a leading digital advertising technology company. Understanding TTD stock is essential for investors looking to navigate the complex landscape of the advertising technology sector.

Current Performance of TTD Stock

As of October 2023, TTD stock has experienced considerable fluctuations, reflecting the volatility associated with tech stocks. After reaching an all-time high earlier in the year, the stock saw a correction, followed by a resurgence as investor sentiment improved. Analysts attribute this rebound to a strong demand for programmatic advertising and the company’s ability to leverage artificial intelligence to optimize advertising strategies.

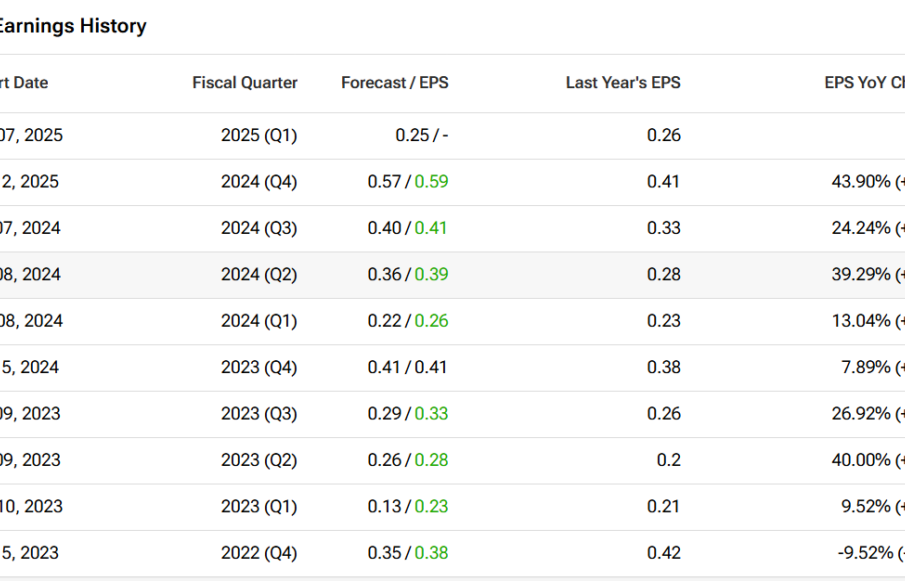

According to recent reports, TTD’s quarterly earnings exceeded expectations, with a year-over-year revenue growth of 25%. This growth is largely driven by increased spending in digital marketing, as companies continue to transition from traditional advertising platforms to digital channels in response to changing consumer behaviors.

Market Trends Influencing TTD Stock

The landscape of digital advertising continues to evolve, with increasing investments flowing into programmatic advertising, which automates the buying and selling of ads. The rise of streaming services and mobile platforms has created new opportunities for advertisers, positioning companies like The Trade Desk favorably within this market. Furthermore, advancements in data analytics and AI technology have provided TTD with the ability to offer real-time insights to advertisers, enhancing campaign effectiveness.

Additionally, recent legislative changes around privacy regulations have posed challenges; however, TTD’s commitment to transparency and user privacy has helped maintain its competitive edge. Industry analysts project that the demand for targeted advertising will only grow, boosting TTD’s prospects in the long term.

Conclusion

With its innovative approach and strong market positioning, TTD stock remains a focal point for investors looking for exposure to the tech-centric advertising space. While short-term volatility is expected, the favorable long-term trends in digital advertising and TTD’s strategic initiatives support a positive outlook. For investors, staying informed about market dynamics and company developments will be crucial in making educated decisions regarding TTD stock. As the digital advertising sector continues to grow, TTD is set to play a significant role, making it a stock worth watching closely.