Current Trends and Analysis of RBC Stock Price

Introduction

The Royal Bank of Canada (RBC) is one of the largest financial institutions in Canada, and its stock price is closely watched by investors and market analysts alike. As a key player in the banking sector, fluctuations in RBC’s stock can have significant implications for both the Canadian economy and the broader financial markets. Analyzing the current stock price and trends is essential for investors looking to make informed decisions.

Current Stock Price Trends

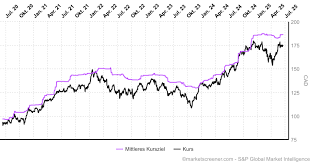

As of late October 2023, RBC’s stock price trades around CAD $139.00, reflecting a modest increase of approximately 2% from the previous month. The stock has shown a steady upward trend this year, with a year-to-date performance of over 12%. Analysts attribute this growth to strong quarterly earnings and solid cost management strategies implemented by the bank.

In the most recent quarterly report, RBC announced a net income of CAD $3.5 billion, up 6% compared to the same period last year. The bank’s diversified revenue streams, which include personal and commercial banking, capital markets, and wealth management, have all reported healthy growth, contributing to the positive stock performance. Moreover, RBC’s focus on digital transformation has enhanced customer experience and operational efficiency, further solidifying its market position.

Market Influences and Future Outlook

Several factors are influencing RBC’s stock price in the current market climate. Rising interest rates in Canada, driven by the Bank of Canada’s monetary policy, are expected to benefit the bank’s net interest margins, which could lead to further profitability. The real estate market’s stabilization and a potential rebound in consumer spending also provide a supportive backdrop for RBC’s future growth.

However, investors should remain cautious as economic uncertainties persist. Potential challenges, such as global trade tensions, inflationary pressures, and the ongoing impacts of the COVID-19 pandemic, could create volatility in the financial markets. Additionally, RBC, like other banks, may face increased regulatory scrutiny that could affect its operational capabilities.

Conclusion

In conclusion, RBC’s stock price reflects its robust financial performance and strategic initiatives. While the current upward trend appears positive, investors must consider broader economic factors that could impact the market. Analysts remain optimistic about RBC’s potential for continued growth in the short to medium term, but vigilance will be crucial as economic conditions evolve. Keeping an eye on RBC’s quarterly results and market strategies will provide valuable insights for investors looking to capitalize on its stock.