Current Trends and Analysis of INTC Stock

Introduction

The performance of Intel Corporation’s stock (NASDAQ: INTC) has been a topic of considerable interest among investors and market analysts in recent months. As a leading semiconductor manufacturer, Intel’s stock is not only significant for its investors but also for the broader technology sector. Understanding the trends surrounding INTC stock can provide insights into the future performance of tech stocks in general.

Current Market Performance

As of October 2023, INTC stock has experienced notable volatility, reflecting broader trends in the technology sector. The stock has fluctuated between $25 and $40 in the last six months, showing a mixed performance in response to quarterly earnings reports and shifts in global semiconductor demand. Recently, Intel announced its third-quarter earnings, which significantly surpassed analysts’ expectations, leading to a temporary spike in its stock price.

Factors Influencing INTC Stock

Several factors contribute to the ongoing performance of INTC stock. Firstly, the growing demand for semiconductor chips, driven by advancements in artificial intelligence (AI) and machine learning technologies, has provided a favorable backdrop for Intel. Additionally, the company’s strategic initiatives, such as investments in manufacturing facilities and research and development, play a crucial role in its competitive positioning.

Moreover, competition from rivals such as Nvidia and AMD continues to pressure Intel. These companies have recently unveiled new products that further enhance their market positions, prompting investors to closely monitor how Intel responds with its upcoming product launches.

Future Outlook

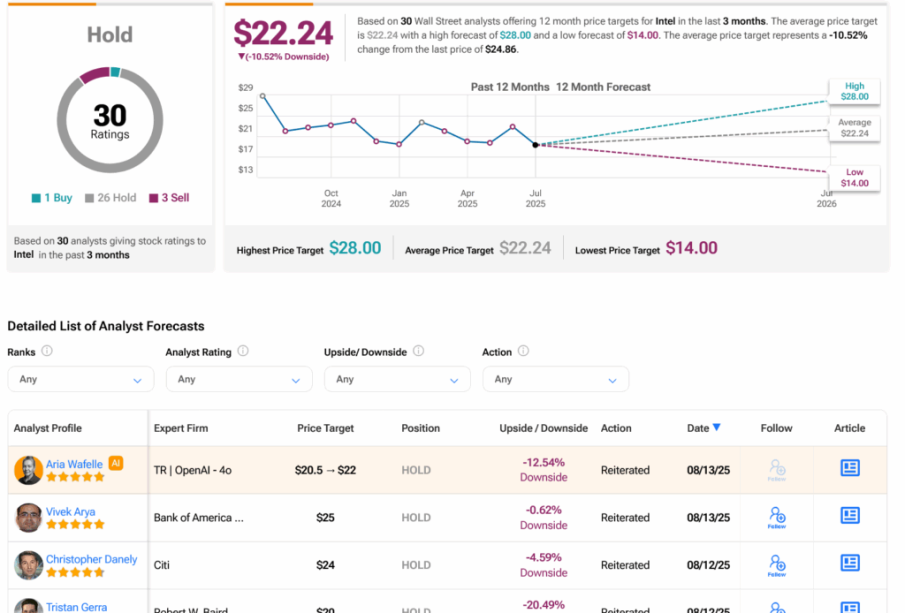

Analysts are mixed in their forecasts for INTC stock. Some believe that as Intel continues to execute its strategy to regain market share, the stock could see a rally, especially if the overall tech market rebounds. Others caution that the company’s ability to innovate will determine its long-term sustainability in a rapidly evolving industry.

Conclusion

For investors, keeping a close eye on INTC stock is essential due to its substantial influence on the technology market segment. The company’s recent performance and strategic decisions will likely play a significant role in shaping the outlook for INTC stock in the upcoming quarters. With the global demand for technology continuing to rise, Intel’s actions in the near future will be pivotal in determining its position in a highly competitive landscape.