Current State of Canada’s Inflation Rate: October 2023

Introduction

The inflation rate in Canada has become a pivotal topic as it affects economic stability, cost of living, and the purchasing power of Canadians. As the country continues to recover from the economic impacts of the COVID-19 pandemic, the current inflation trends warrant close attention from both policymakers and consumers. Understanding where the inflation rate stands today is crucial for making informed financial decisions.

Current Inflation Trends

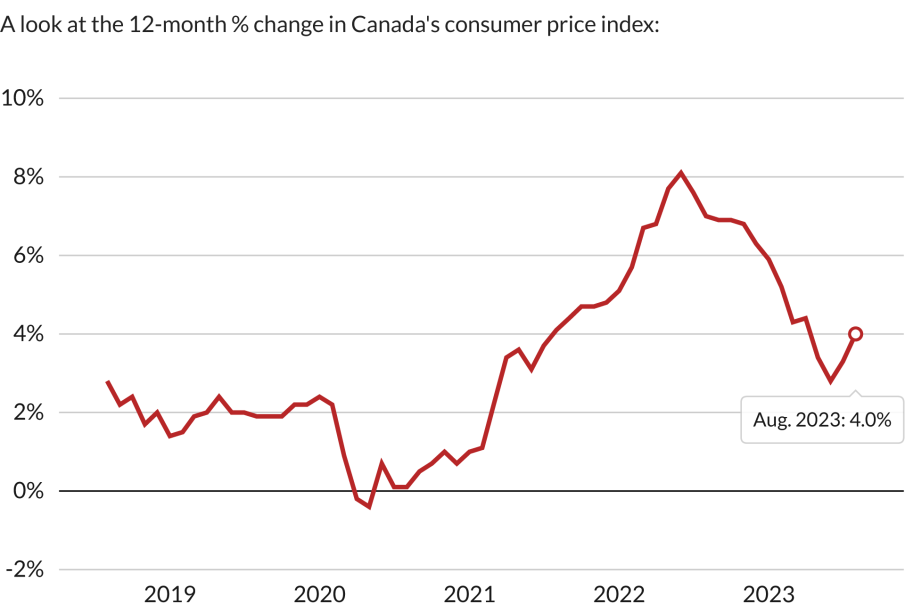

As of October 2023, Canada’s inflation rate stands at 4.1%, a notable decline from 4.9% reported in the previous month, according to Statistics Canada. The decreasing trend is viewed cautiously, with analysts suggesting that government efforts and recent interest rate hikes by the Bank of Canada may be contributing factors. However, the inflation rate remains above the central bank’s target of 2%, prompting ongoing debates among economists regarding future monetary policy adjustments.

Factors Contributing to Inflation

Several factors have been influencing the current inflation rate, including:

- Energy Prices: Fluctuations in global oil prices have a significant impact on the overall inflation rate, with rising costs in this sector affecting transportation and goods.

- Food Costs: Food inflation remains a concern, with prices escalating due to climate-related crop failures and supply chain disruptions.

- Government Policy: Stimulus measures and reduced interest rates during the pandemic initially helped stimulate the economy but have also been linked to rising inflation.

Predictions and Economic Outlook

Looking ahead, experts predict that while inflation may continue to moderate, risks remain that could lead to fluctuations. Factors such as geopolitical tensions, ongoing supply chain issues, and potential further interest rate changes by the Bank of Canada may influence future inflation trends. Economists advise consumers to be cautious in their spending and investment practices as the economy adjusts in the coming months.

Conclusion

The current inflation rate of 4.1% in Canada represents a significant point of discussion in economic circles, affecting everything from consumer prices to investment strategies. As the government and Bank of Canada navigate these challenges, it is vital for individuals to stay informed about economic indicators and be prepared to adjust their financial plans accordingly. Keeping an eye on inflation trends is essential for all Canadians as they strive to maintain financial stability in these uncertain times.