Current Insights on NVDA Stock Price

Introduction

The stock price of NVIDIA Corporation (NVDA) has become a focal point for investors and analysts alike, especially given its pivotal role in the technology sector. With advancements in artificial intelligence (AI) and gaming hardware driving demand, understanding the fluctuations in NVDA’s stock price is crucial for those interested in the tech market and investment opportunities.

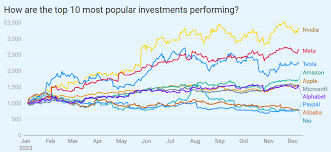

Recent Stock Performance

As of October 2023, NVDA stock has shown remarkable resilience, reaching an all-time high of approximately $500 per share earlier this month. This surge is largely attributed to increased sales from its AI-driven products and a growing demand for GPUs in data centers. Analysts project that as companies continue to invest in AI technologies, NVIDIA’s market position is likely to strengthen, directly affecting its stock price positively.

Market Trends Influencing NVDA

The technology sector, particularly AI, is experiencing unprecedented growth. Major enterprises are adopting AI tools at a rapid pace, thereby increasing the sales of NVIDIA’s graphics cards. Furthermore, the release of new products, including the anticipated next generation of graphics processing units (GPUs), is expected to boost investor confidence and drive the stock higher.

In addition to product demand, external factors such as global supply chain issues and economic policies can influence NVDA’s stock price. Investors are closely monitoring these elements, as poor performance in these areas could lead to stock volatility.

Expert Forecasts and Investor Sentiment

Market analysts are divided in their predictions for NVDA’s stock. While some foresee continued growth due to its solid fundamentals and expanding market share, others caution about potential overvaluation and the risk of a market correction. Investor sentiment remains high, as evidenced by the high trading volumes in the past few weeks.

Conclusion

In conclusion, NVDA’s stock price reflects its robust business model and the growing importance of AI in the global market. For investors, keeping an eye on technological advancements and market trends is essential for making informed decisions. Analysts recommend a cautious approach: while the potential for growth remains strong, investors should also be wary of market fluctuations. Overall, NVDA’s prospects appear promising, making it a significant player in the stock market for the foreseeable future.