Current Insights on JPM Stock and Market Performance

Introduction to JPM Stock

The stock of JPMorgan Chase & Co. (JPM) is a significant indicator within the financial sector, reflecting both corporate health and broader economic trends. As one of the largest banks in the United States, JPM’s stock is closely watched by investors and analysts alike for its insights into consumer confidence, interest rate changes, and regulatory impacts. With recent volatility in the markets due to inflation concerns and geopolitical tensions, understanding the movements of JPM’s stock is crucial for those engaged in financial markets.

Recent Performance of JPM Stock

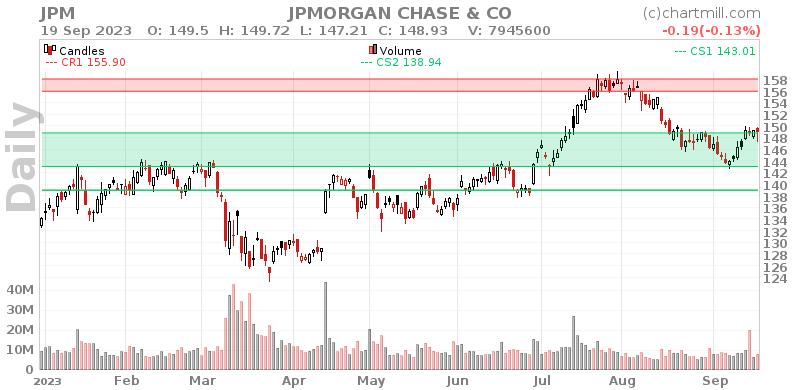

As of late October 2023, JPM stock has experienced fluctuations reflecting both strong earnings reports and external economic pressures. In its latest quarterly earnings report, JPMorgan announced a 10% increase in profits year-over-year, driven mainly by robust trading revenues and a strong lending environment. The stock surged following the announcement, reaching a peak of $150 per share.

However, the stock faced challenges as overall market sentiment shifted due to concerns over rising interest rates. Analysts predict that if the Federal Reserve continues to increase rates to combat inflation, banks like JPM may face higher funding costs and potential declines in loan demand. This has led to a slight retraction in JPM’s stock price, which hovered around $145 per share by mid-October.

Market Trends and Future Outlook

Looking forward, the outlook for JPM stock remains cautiously optimistic. Analysts project the bank will continue to show strong performance in the coming quarters, especially if macroeconomic conditions stabilize. The bank’s diverse revenue streams, including investment banking and asset management, provide a buffer against market volatility.

Moreover, the ongoing digital transformation initiatives that JPM has been implementing may yield significant long-term benefits. As the bank invests in fintech solutions and enhances its digital offerings, analysts believe this could further improve operational efficiencies and customer engagement.

Conclusion

In conclusion, JPM stock is a critical barometer for the financial industry. While current challenges related to interest rates and economic uncertainties exist, the fundamentals of JPMorgan Chase & Co. appear solid. As investors navigate the complexities of the market, keeping a keen eye on JPM’s stock performance will provide insights not just into the health of the bank, but also into the broader economic landscape. For those considering investments, it remains essential to stay informed about market conditions and JPM’s strategic developments.