CoreWeave Stock Rallies on AI Ventures Launch as Company Expands Infrastructure Portfolio

Market Performance and Recent Developments

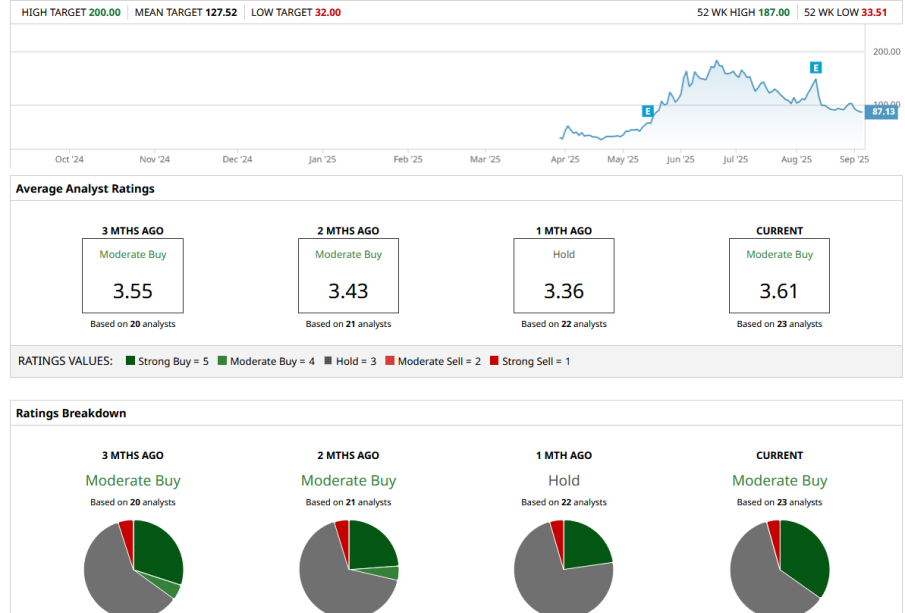

CoreWeave (NASDAQ: CRWV) is currently trading at $100.22, with the stock showing significant volatility as it moves within a day range of $97.05 to $103.89. The company’s 52-week trading range spans from $33.52 to $187.00, highlighting the dynamic nature of its market performance.

CoreWeave is a cloud infrastructure technology company that specializes in the CoreWeave Cloud Platform, offering software and cloud services designed specifically for managing complex artificial intelligence (AI) infrastructure. The platform is purpose-built for running AI workloads, including model training and inference.

Financial Performance and Growth

The company has demonstrated remarkable growth, with Q2 2025 revenue surging 207% year-over-year to $1.213 billion, with 98% of revenue coming from long-term contracts. The company’s revenue backlog has expanded significantly to $30.1 billion, representing an 86% year-over-year increase, primarily driven by expansions from existing major customers.

Recent Strategic Initiatives

CoreWeave has recently launched CoreWeave Ventures, a significant initiative that reinforces their commitment to powering AI platforms. The market responded positively to this announcement, with the stock climbing as much as 8% following the news.

The company has been expanding its business relationships, notably with OpenAI during the second quarter, while also establishing partnerships with major financial institutions including Goldman Sachs and Morgan Stanley.

Market Outlook and Challenges

Analysts have set an average 12-month price target of $121.77 for CoreWeave, with estimates ranging from $32 to $180. Currently, 7 analysts recommend buying the stock, while 3 suggest selling, resulting in a Neutral rating overall. The stock is believed to have a +21.50% upside potential.

However, the company faces certain challenges as it continues its rapid expansion. Market participants have expressed some concerns regarding capital expenditures, which have become a significant factor in the corporate landscape.