CNR Stock: Current Trends and Insights

Introduction

Canadian National Railway Company (CNR), as one of North America’s largest freight rail networks, plays a vital role in the transportation sector and the economy at large. Monitoring the performance of CNR stock (NYSE: CNI) is essential for investors looking to navigate the turbulent waters of the stock market. CNR not only influences the transportation of goods across Canada and the U.S. but also serves as a bellwether for broader economic conditions. Recent shifts in the stock market and economic indicators make analyzing CNR stock particularly relevant right now.

Recent Stock Performance

CNR stock has recently experienced fluctuations as economic conditions evolve, with a notable peak in mid-2023, where shares briefly hit $140 each amid strong quarterly results. However, as of October 2023, CNR stock has seen a slight decline, trading around $130, primarily due to rising operational costs and global supply chain challenges. The company reported an increase in freight shipments in key sectors like forestry and automotive, although these gains were offset by a downturn in coal and petroleum shipments, leading to a mixed performance overall.

Market Analysis

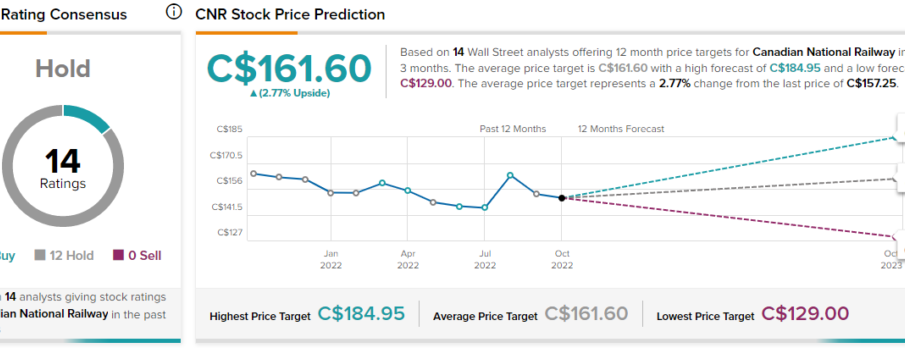

Analysts are closely scrutinizing CNR’s strategy as the company adapts to changing market dynamics. Increased focus on sustainability and the integration of technology into operations have become central themes. Analysts at major financial institutions have issued mixed ratings, reflecting uncertainty in the freight market’s recovery trajectory and changing consumer demand. While some analysts remain optimistic about CNR’s long-term growth potential, others highlight risks associated with economic downturns and interest rate hikes impacting capital costs.

Conclusion

In summary, CNR stock remains a significant player within the transport and logistics sector. As North America continues to grapple with economic challenges, including inflation and shifting consumer behavior, CNR will likely remain a focal point for investors. Moving forward, those looking to invest in CNR should weigh the company’s strategic initiatives against continuing market volatility. Maintaining a long-term perspective while keeping an eye on fluctuations in the industry will be crucial for making informed investment decisions. Regulatory changes, technological advances, and global economic trends will all play a part in how CNR navigates the upcoming quarters.