Cava Stock: Recent Trends and Market Insights

Introduction

Cava Group Inc., known for its Mediterranean-inspired fast-casual dining concept, has made recent waves in the stock market. As a relatively new player since going public in 2023, its stock performance is crucial not only for investors but also for the broader food industry. Understanding the factors influencing Cava’s stock can help potential investors and industry watchers make informed decisions.

Current Performance Overview

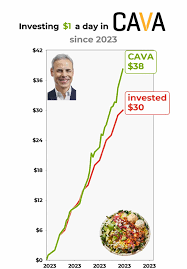

Since its IPO, Cava stock has experienced notable fluctuations. Priced at $22 per share at its debut, it has seen both highs and lows, reflecting the volatile nature of the market, especially in the food sector. Data from recent trading sessions shows Cava stock hovering around $25, having fluctuated between $20 and $28 in the past few months.

Analysts attribute these fluctuations to various factors, including changes in consumer dining trends and broader economic conditions. For instance, a surge in health-conscious eating habits has benefited Cava, as its menu aligns well with these preferences, contributing to increased customer traffic and sales.

Market Trends Influencing Cava Stock

The fast-casual dining segment has been prolific in 2023, with Cava among the brands that caught the market’s attention. Increased demand for plant-based and Mediterranean cuisine has positioned Cava favorably among its competitors. Recent reports indicate that Cava plans to expand its locations from 40 to over 100 by 2025, which analysts believe could positively impact its stock value as market penetration increases.

Moreover, investments in technology to improve online ordering and delivery services have become essential, particularly following the pandemic’s impact on dining. Cava’s emphasis on enhancing customer experience through digital channels suggests a proactive strategy that might boost its stock performance in the near future.

Analyst Sentiment and Future Forecasts

Investor sentiment around Cava stock is mixed but increasingly optimistic. Many analysts project a growth trajectory driven by expanding market share and continuous menu innovation. According to reports by reputable investment firms, Cava could see its stock price rise to $30 within the next year if current growth trends persist. However, market volatility and competition do pose risks that potential investors should consider.

Conclusion

In summary, Cava stock represents both potential opportunities and challenges as it navigates a competitive food landscape. With demand for healthy dining options on the rise, Cava’s strategic expansions and technological advancements may very well lead to positive long-term performance. For investors, an understanding of these dynamics is key to making informed decisions about this burgeoning stock.