Без рубрики

The Rise of Garrett Wilson: NFL’s Next Star Wide Receiver

Introduction Garrett Wilson, a standout wide receiver in the NFL, has quickly become one of the most talked-about players in professional football. ...Typhoon in the Philippines: Current Events and Impacts

Introduction The ongoing threat of typhoons in the Philippines poses significant challenges to the nation, known for its stunning landscapes yet vulnerable ...Leicester City vs Middlesbrough: A Clash of Ambitions

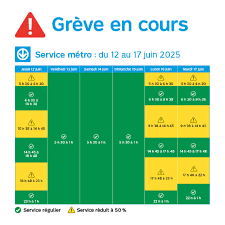

Introduction The recent face-off between Leicester City and Middlesbrough in the EFL Championship garnered significant attention, illustrating the competitive nature of the ...Grève STM Horaire : Que Faut-il Savoir ?

Introduction La grève des employés de la Société de transport de Montréal (STM) a suscité beaucoup d’attention récemment, tant pour son impact ...The Washington Post: A Pioneering Force in Modern Journalism

Introduction The Washington Post is one of the most influential newspapers in the United States, known for its rigorous journalism and in-depth ...Exploring the Works of Laurent Mauvignier

Introduction to Laurent Mauvignier Laurent Mauvignier is a celebrated French novelist whose works have significantly influenced contemporary literature. Born in 1967, Mauvignier’s ...Disney+: The Evolving Landscape of Streaming Entertainment

Introduction Disney+, the streaming service launched by The Walt Disney Company in November 2019, has rapidly transformed the digital entertainment landscape. As ...Tony Pollard: A Key Player for the Dallas Cowboys

Introduction Tony Pollard has emerged as one of the most exciting players in the NFL, particularly for the Dallas Cowboys. As a ...Connections Hints Today: Elevate Your Puzzle Game

The Importance of Hints in Puzzle Solving Puzzles have long been a favorite pastime for many, enabling people to challenge their minds ...Understanding Place 0-5: The Future of Urban Development

The Importance of Place 0-5 in Canadian Cities In recent urban planning discussions, the concept of Place 0-5 has gained traction among ...