Boeing Stock: Current Trends and Market Insights

Introduction

Boeing stock has been a focal point for investors and analysts alike, especially in the wake of recent events impacting the aerospace industry. As one of the largest aerospace companies in the world, Boeing’s performance is closely watched, not just for its stock value but also for its implications on the economy and the aviation sector. In this article, we will delve into the current state of Boeing stock, factors influencing its price, and what the future may hold.

Recent Performance and Market Trends

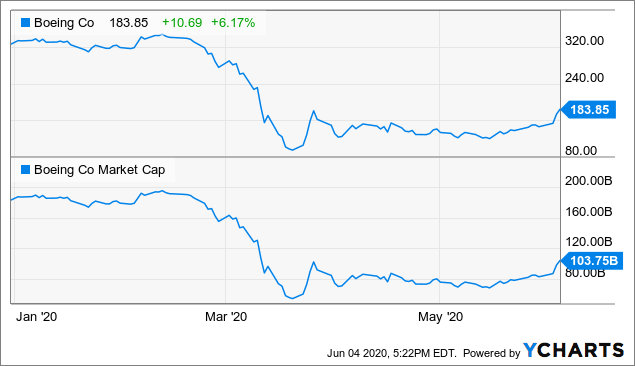

As of October 2023, Boeing’s stock has witnessed significant fluctuations, largely influenced by various factors including supply chain issues, production delays, and global demand for air travel. Following a challenging period marked by the 737 MAX crisis and the fallout from the COVID-19 pandemic, Boeing has taken steps towards recovery, showing promising signs in recent quarters.

In Q3 2023, Boeing reported a revenue increase of 15% year-over-year, driven by higher deliveries of commercial aircraft. However, challenges remain, including ongoing litigation and regulatory scrutiny concerning safety and compliance issues. Investors have reacted positively to Boeing’s efforts to streamline operations and cut costs, as evidenced by a rise in stock prices from an earlier low.

Outlook for Boeing Stock

The outlook for Boeing stock seems cautiously optimistic amidst the recovery of the travel sector. Analysts predict that as global air travel continues to rebound, demand for new aircraft will likely increase, potentially bolstering Boeing’s sales. Additionally, the company is working on advancing its sustainability initiatives, which may attract a new wave of investment.

However, it is important for investors to remain vigilant, as external factors such as geopolitical tensions, fluctuating fuel prices, and competition from other aerospace firms could impact Boeing’s performance moving forward. Analysts recommend closely monitoring quarterly earnings reports and industry developments for a clearer picture of where Boeing stock may head in the coming months.

Conclusion

Boeing stock remains a key indicator of the aviation industry’s health, and while recent trends show signs of recovery, the company is not without its challenges. Investors are encouraged to maintain an informed perspective, considering both the potential for growth and the risks ahead. As the aviation sector evolves, Boeing’s actions and market dynamics will continue to play a critical role in determining its stock performance and overall market confidence.