BNS Stock on TSX: Current Trends and Future Outlook

Introduction

The Bank of Nova Scotia (BNS), listed on the Toronto Stock Exchange (TSX), is one of Canada’s largest banks, providing significant insights into the financial sector’s performance. With its stock being closely monitored by investors, understanding the latest trends and economic factors influencing BNS stock is crucial for those engaged in Canadian markets.

Recent Performance of BNS Stock

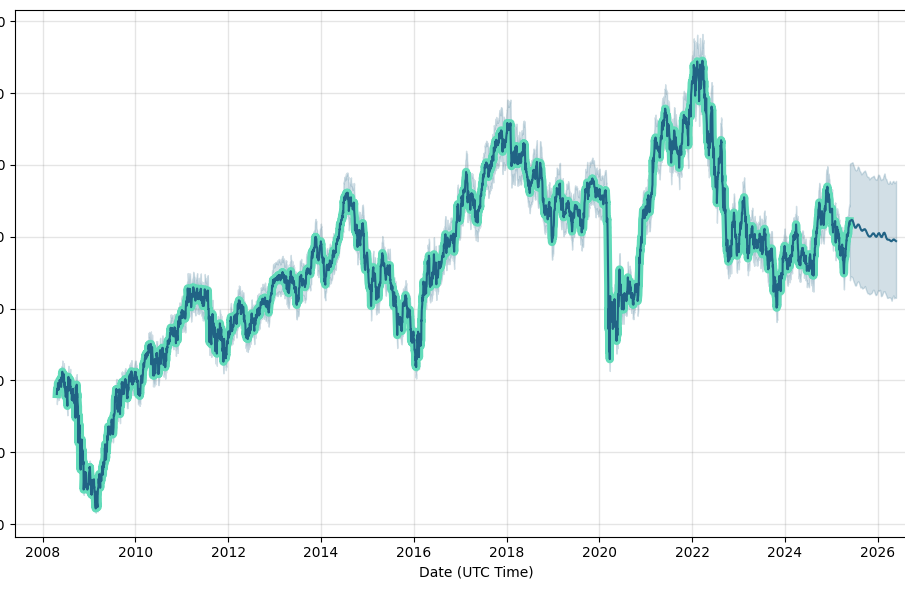

As of late October 2023, BNS stock has seen various fluctuations attributed to changing market conditions and economic factors. Currently trading around CAD $70 per share, BNS has shown resilience amid challenges faced by the banking sector, including interest rate adjustments made by the Bank of Canada in response to inflationary pressures. Over the past month, the stock has experienced a 5% increase, driven by strong quarterly earnings reported on October 25, which exceeded analysts’ expectations.

Market Influencers and Economic Factors

BNS’s performance on the TSX does not exist in a vacuum; it is heavily influenced by broader economic indicators. The Canadian economy’s growth rate, consumer confidence, and employment statistics all play significant roles in shaping investor sentiment around bank stocks. Increased interest rates can potentially benefit banks through wider margins on loans, yet they also pose risks to borrowers, impacting loan defaults. The recent uptick in the Canadian job market has instilled confidence among investors, encouraging them to hold on to BNS stock despite concerns over rising borrowing costs.

Outlook for BNS Stock

Analysts are cautiously optimistic about the BNS stock in the foreseeable future. Many anticipate that if the Canadian economy continues to stabilize, BNS will maintain its upward trajectory, potentially reaching CAD $75 within the next quarter. However, investors are advised to keep an eye on macroeconomic indicators, as global economic slowdowns or significant changes in the Canadian monetary policy could affect performance.

Conclusion

In summary, BNS stock on the TSX remains a focal point for market watchers and investors alike. Its recent performance reflects both the strength of the bank itself and external economic conditions. By staying informed on economic trends and market shifts, investors can better navigate their decisions concerning BNS stock, optimizing their portfolios in an ever-changing landscape.