AVGO Stock: Latest Insights and Market Trends

Introduction

AVGO stock, associated with Broadcom Inc., has recently become a focal point in the technology and semiconductor markets. As one of the leading semiconductor companies globally, Broadcom’s stock performance is closely tied to the industry’s innovations and market conditions. In this article, we explore current trends, financial performance, and what the future holds for AVGO stock.

Recent Market Performance

As of early October 2023, AVGO stock has shown resilience amidst the fluctuations typical in the semiconductor industry. At the start of the month, AVGO shares were trading at approximately CAD 884, reflecting a steady increase of about 15% compared to the previous quarter. Analysts attribute this growth to enhanced demand for semiconductors used in data centers and 5G technology, which are critical drivers of Broadcom’s product lines.

Moreover, Broadcom’s recent earnings report revealed robust revenue growth of approximately 20% year-over-year, propelled by its expanding cloud and wireless segments. This positive financial outlook has boosted investor confidence, leading to increased trading volume in AVGO stock.

Future Projections

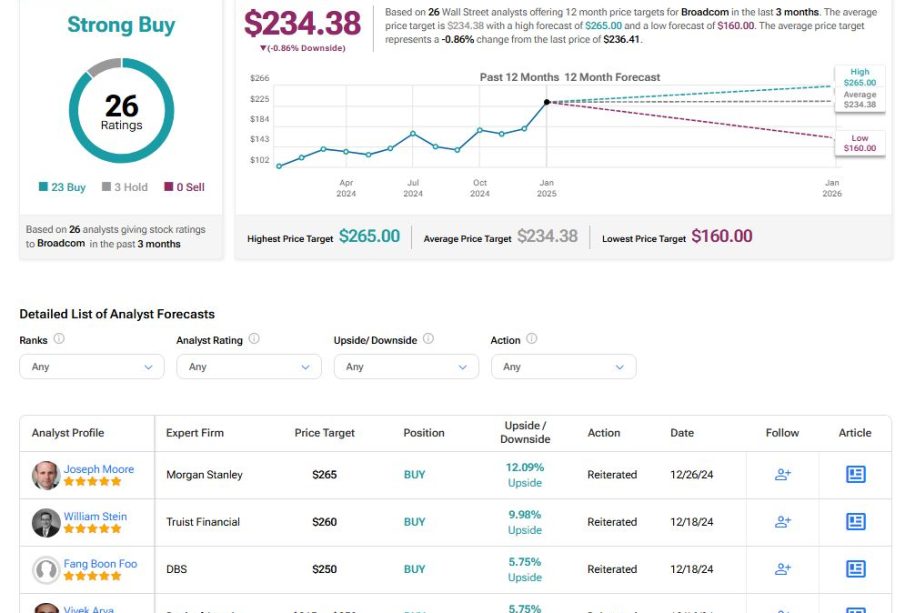

Looking ahead, analysts remain optimistic about AVGO stock’s trajectory. According to recent forecasts, the semiconductor market is expected to grow significantly over the next five years, driven by advancements in AI, automotive technology, and the broader adoption of IoT devices. If these trends continue, Broadcom is well-positioned to capitalize on this growth, potentially leading to further stock appreciation.

Investment Considerations

Investors considering AVGO stock should note a few key factors. The semiconductor sector is known for its cyclicality, meaning that while current demand is high, it can be affected by global economic conditions and supply chain disruptions. Additionally, competition from other leading semiconductor companies could impact Broadcom’s market share.

Conclusion

In summary, AVGO stock remains a compelling option for investors looking to engage with the semiconductor industry. Its recent performance and positive market outlook suggest strong potential for growth. However, as with any investment in volatile sectors, it is essential for investors to conduct thorough research and to be aware of the inherent risks involved. Keeping a close watch on market trends and Broadcom’s strategic moves will be crucial for investment decisions in the coming months.