Analyzing the Recent Trends in Broadcom Stock

Introduction

The stock market is a dynamic environment, with technology stocks often leading the way in terms of growth and volatility. Broadcom Inc., a prominent player in the semiconductor and infrastructure software industry, has attracted considerable attention from investors. Understanding the performance of Broadcom stock is crucial, especially as it directly reflects the broader trends in technology and telecommunications sectors.

Current Performance

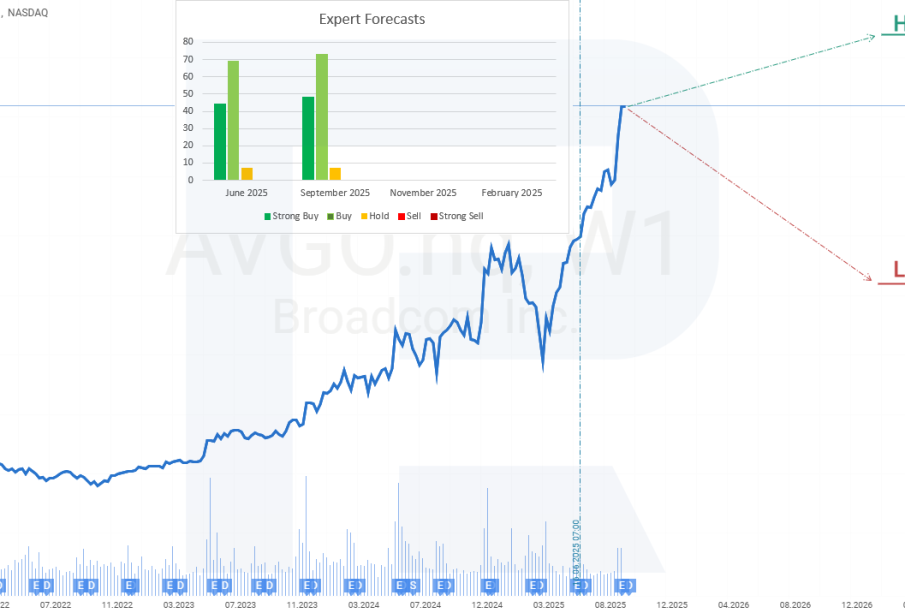

As of October 2023, Broadcom’s stock has shown resilience amidst market fluctuations. The stock is trading at approximately $840, reflecting a steady increase of over 15% year-to-date. Analysts attribute this growth to strong revenue reports stemming from increased demand for data centers and the expansion of 5G technology. Recent quarterly earnings surpassed expectations, generating optimism among investors.

Moreover, Broadcom’s diversification strategy into software solutions has also fortified its market position, allowing it to withstand sector-specific downturns. The company’s announced acquisition of VMware has garnered support, suggesting a significant shift towards integrated software and infrastructure capabilities.

Market Opportunities and Challenges

The demand for semiconductors is expected to rise, driven by digital transformation across various industries. Analysts foresee opportunities in artificial intelligence (AI) and Internet of Things (IoT) sectors, where Broadcom’s technology plays a pivotal role. However, potential challenges, such as supply chain constraints and geopolitical tensions, loom on the horizon, potentially affecting production and distribution.

Conclusion and Forecast

In conclusion, Broadcom stock is currently a focal point for investors, showcasing substantial growth potential as the tech landscape evolves. While the company faces adversities, its strategic initiatives and adaptability suggest a promising outlook. Experts forecast that if the momentum continues, Broadcom may remain a key player in the semiconductor market, with stock price projections potentially reaching $900 within the next 12 months.

For investors, keeping a close eye on Broadcom’s quarterly earnings and market positioning will be essential in capitalizing on potential growth opportunities.