Analyzing the Recent Trends and Performance of Apple Stock

Introduction

Apple Inc. (AAPL) has long been one of the most closely monitored stocks in the technology sector. Its performance is not just critical for investors but also serves as a bellwether for the tech industry as a whole. As of late October 2023, AAPL has shown both resilience and volatility against a backdrop of changing economic conditions and rising interest rates.

Current Market Overview

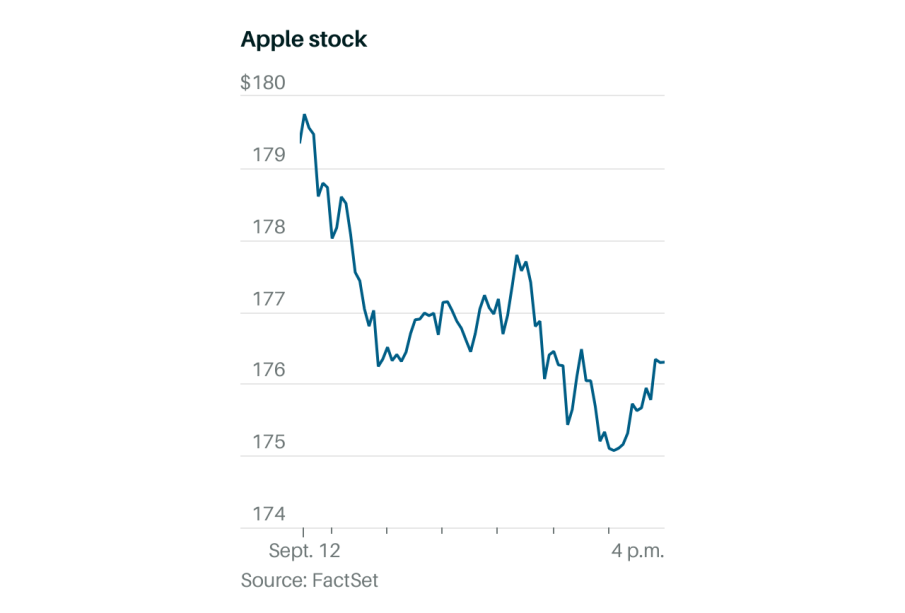

As of the most recent trading week, Apple stock is trading at around $175, slightly down from its peak earlier in 2023, where it approached the $200 mark. The recent decline can be attributed to several factors, including fluctuating demand for consumer electronics, supply chain issues, and broader market instability spurred by rising inflation.

Despite the slight downturn, analysts remain optimistic about Apple’s long-term growth potential. The company continues to diversify its revenue streams beyond its flagship iPhone, with significant investments in services and wearables, contributing positively to its bottom line. Q3 2023 reports showed service revenue reached a record high, indicating a positive shift in consumer behavior towards services like Apple Music, iCloud, and Apple TV.

Recent Developments

In the past month, Apple has made headlines with upgrades in its product lines, including the launch of the iPhone 15 and new updates to the MacBook series. This is expected to stimulate sales during the holiday season. More importantly, the company’s push towards augmented reality (AR) technology is generating excitement about potential future revenues.

Furthermore, Apple’s recent announcement regarding stock buybacks demonstrates its commitment to returning value to shareholders amidst a turbulent economic landscape. The company has authorized an additional $90 billion for share repurchases, signaling confidence in its long-term performance and market presence.

Conclusion

In conclusion, while Apple stock has encountered some challenges in the short term, the long-term outlook remains positive thanks to the company’s strong brand loyalty, innovative product lines, and expanding service offerings. Investors should keep an eye on upcoming earnings reports and product launches, as these will likely have a significant impact on stock performance. Overall, understanding the dynamics surrounding Apple’s stock is essential for investors navigating today’s market.