Analyzing Tesla Stock: Trends and Future Predictions

Introduction

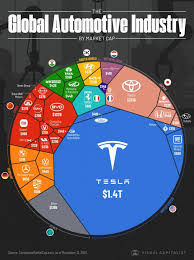

Tesla Inc. (NASDAQ: TSLA), the electric vehicle giant led by CEO Elon Musk, has become a focal point for investors and market analysts alike. The performance of Tesla stock is not just a reflection of the company’s innovative advancements in the automotive and energy sectors, but it also serves as an indicator of the broader market sentiment towards technology stocks and sustainability initiatives. With increasing competition in the EV space and fluctuating market dynamics, understanding Tesla’s stock movements has never been more crucial.

Current Market Performance

As of October 2023, Tesla’s stock has experienced significant volatility. After reaching an all-time high of around $300 per share in late 2021, the stock has faced challenges, trading around $220 per share recently. Analysts attribute this decline to various factors including rising interest rates, global supply chain constraints, and the increasing competition from established automakers like Ford and General Motors, who are ramping up their electric vehicle production.

Moreover, the recent quarterly earnings report, released in October 2023, showed a 10% increase in revenue year-over-year, primarily driven by stronger sales in Europe and Asia. However, the company reported lower-than-expected delivery numbers, which raised concerns about whether Tesla can maintain its growth trajectory amidst intensifying competition.

Investor Sentiment and Future Outlook

Investor sentiment towards Tesla remains a mix of optimism and apprehension. Many seasoned investors are watching for Tesla’s upcoming battery day and annual shareholder meeting, which are expected to provide insights into new technologies and production capabilities. These events could play a pivotal role in shaping the company’s stock prospects for the coming year.

Market analysts predict that if Tesla continues to innovate and scales its production effectively, the stock could rebound. Moreover, with the broader push towards sustainability and government incentives for electric vehicles, Tesla might benefit from favorable regulatory changes that could bolster its market position.

Conclusion

In summary, Tesla stock has been a rollercoaster of highs and lows, reflecting both the company’s performance and wider market trends. For investors, staying informed about Tesla’s strategic moves and the evolving competitive landscape will be vital for making informed decisions. As the electric vehicle market continues to grow, the potential for Tesla stock remains strong, but it is essential for investors to approach it with caution and a well-researched strategy. The forthcoming months could be critical in determining whether Tesla stock regains its former glory or continues to tread water amidst growing competition.